Asset-based lending for SMEs – An underappreciated form of company funding

20 October 2021

In addition to the ongoing digitalization of lending processes, there is an increasing need for frictionless lending.

In addition to the ongoing digitalization of lending processes, there is an increasing need for frictionless lending.

In the B2C market, consumer credits can already be originated with a few clicks and fully online. This is for example the case for credit cards, overdrafts, installment loans and more recently Buy Now Pay Later (BNPL). Additionally many banks are further digitizing their mortgage origination processes, allowing customers to simulate and initiate a home loan without visiting the bank branch.

In the B2B market however, we still see a lot of manual efforts. For large enterprises this can be justified to some extent, given the typically high credit amounts and the large degree of customization. However for SMEs this is less acceptable both from the customer and bank point of view.

The customer representative is often the CEO (or CFO) themselves performing those operations, meaning they want to have this as quickly and as efficiently as possible. Furthermore SMEs often don’t have the tooling to optimize for cash management, which means a rapid credit origination can mean the difference between life and death of the business. For banks, the (lower) loan amounts for SMEs often don’t justify a high degree of human interaction, as this would reduce the profit margins.

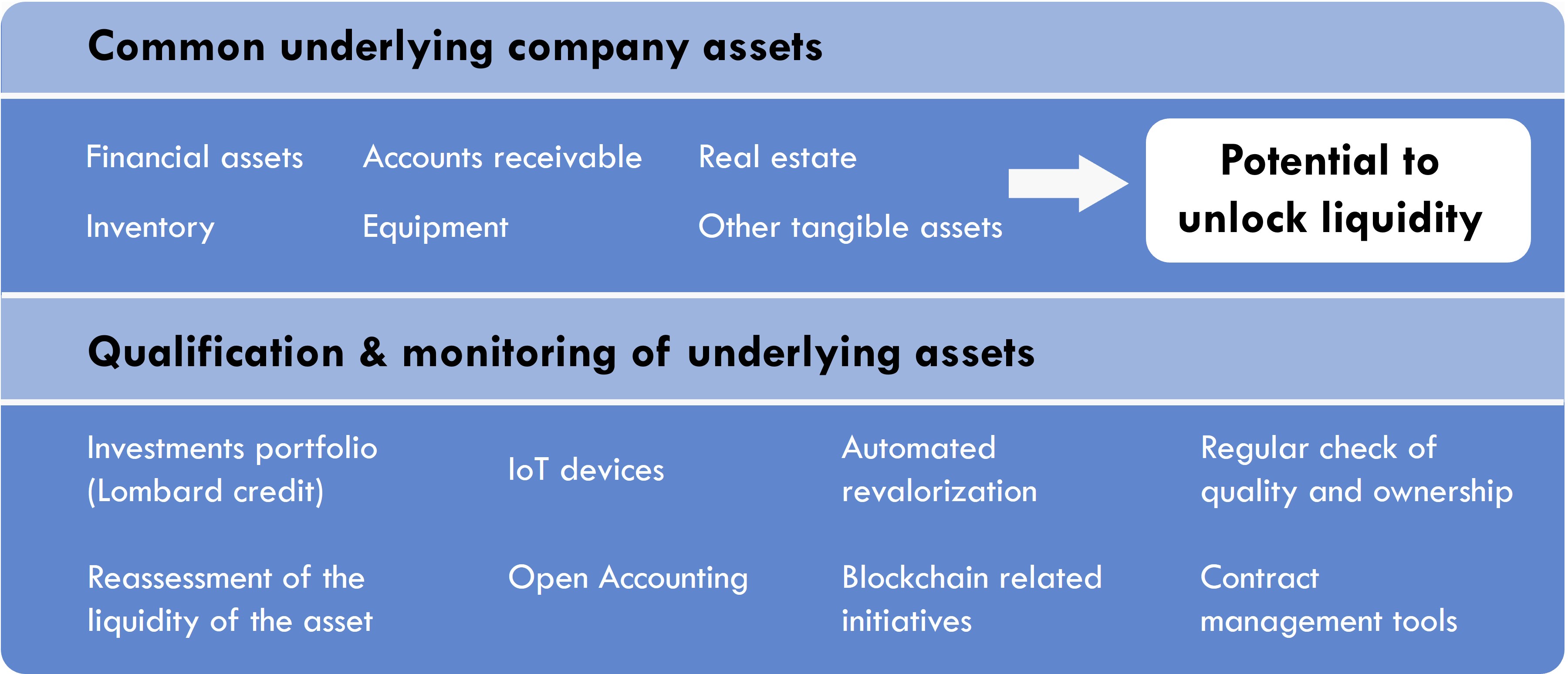

As a result, there is a need for further digitalization (in the form of online self-service). Many SME lending products are already well automated, like an overdraft facility or a fiscal credit, and more recently several Fintech offers have come to the market automating invoice factoring (i.e. using accounts receivable or invoices as the underlying asset product for a credit). However asset-based loans still remain quite manual, as the underlying asset (collateral) needs to be identified, described, analyzed (e.g. checking the quality, the ownership of the asset, the liquidity of the asset, etc.) and valorized, which is much more difficult to automate.

Nonetheless new techniques can make this qualification of underlying assets much more frictionless and automated. Some examples are:

- In case the asset concerns a securities account or insurance contract under management at the bank, a so-called Lombard Credit loan can be ideal. As these assets are very standardized and are under full control of the bank, it is possible to originate these credits in a few clicks. Cfr. the Lombard² offering of Capilever.

- IoT devices (like sensors) can help in the continuous supervision of the underlying assets (i.e. monitoring if asset still exists and if its quality has not decreased). This allows a continuous follow-up of the underlying assets and can automate certain labor-intensive manual tasks done today.

- An automated revalorization of assets can be done via estimation models, e.g. adapting the value using asset-linked indexes (cfr. NLPT offering of Capilever) or using specific service providers (e.g. Rockestate).

- A regular check of quality and ownership can be supported by automated alerting when a check is needed, supported by the upload of certain proof documents or a simple picture of the asset (cfr. NLPT offering of Capilever).

- Open Accounting can help banks to get an immediate real-time connection with the last accounting situation of the company, allowing to pull real-time information about certain assets. Tools like Silverfin, Xero, Sage, Intuit QuickBooks, etc. can help with this. Such a connection allows to assess the creditworthiness of an SME by evaluating the real-time business performance, rather than using outdated annual reports. Increasingly more banks are also offering value-added services to SMEs for financial management (e.g. to predict future liquidity). Offering those tools also allows banks to get better insights in the trustworthiness, liquidity and solvability of an SME customer.

- A number of blockchain related initiatives are being developed, which will publicly store the ownership of certain assets (like property, art, etc.).

- Contract management tools, which allow to automatically generate tailor-made collateral-contracts, based on an extensive rule set, which determines how to compose the contract by concatenating a number of standard paragraphs and clauses.

For banks, assessing collaterals should be a continuous and holistic effort, i.e.

- A collateral should ideally be a mix of different asset types. E.g. a property keeps a relatively stable value and is less risky, but is not very liquid, while certain inventory could be liquidated much more quickly but can also rapidly lose its value (e.g. when the product expiration date has passed). For banks it can therefore be interesting to use a pool of collaterals, with different characteristics in value stability and liquidity. The better the quality of the asset pool, the lower the lender’s risk and the lower the interest rate.

- A continuous monitoring of the underlying assets is required, i.e. not just at the moment of origination. This means a regular check of the quality and ownership of the asset, reassessment of the liquidity of the asset and a revaluation of the asset. This way the lender ensures sufficient collateral value remains in case of credit reimbursement issues or even defaults. It also means that margin calls should be foreseen when the collateral value no longer covers the outstanding credit amount.

Despite its enormous potential as illustrated above, asset-based lending is still underappreciated. Most SMEs have significant cash tied up in assets, like inventory, machines/equipment, real estate or financial assets. Using those assets in an easy and flexible way for lending could unlock huge liquidity amounts.

For both banks and SMEs this can be a reliable access to capital with limited risk. It makes SMEs also less dependent on credit scores, allowing a more forward-looking credit risk assessment (cfr. blog “Improving traditional credit scoring with a forward-looking approach”). This means that you can qualify even as a young or new business, as long as you can provide the necessary assets as collateral.

Feel free to contact Capilever if you want to brainstorm on initiatives that could improve the digitalization of asset-based loans.