Non-liquid position tool (NLPT)

Activating assets not serviced by your bank

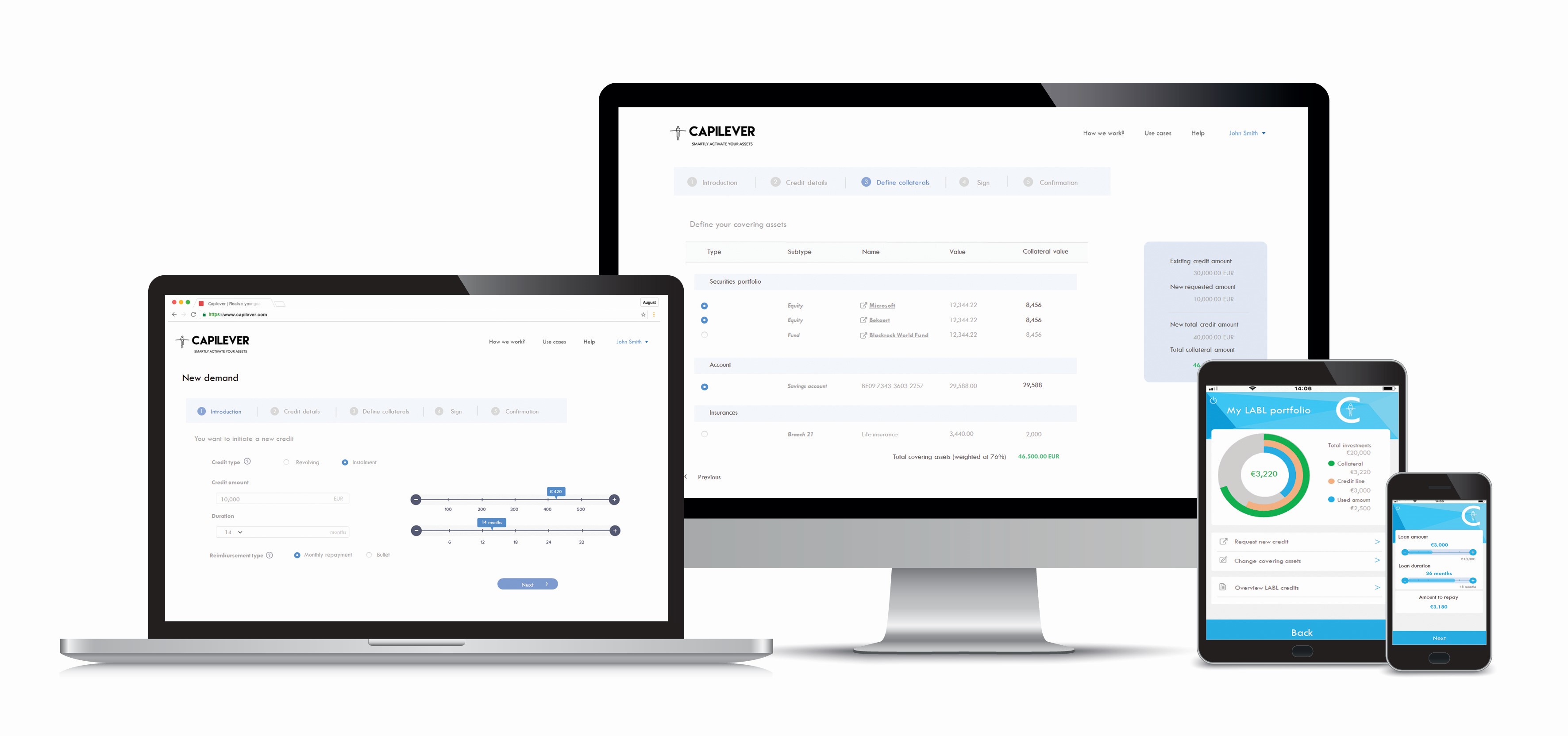

Our non-liquid position tool (NLPT) product provides an end-to-end solution for managing all customer’s assets, liabilities and off-balance positions not serviced by the bank. The solution allows bank employees and customers to keep track of all their non-liquid positions and associated transactions, supporting (semi-automated) valuations and providing a centralized overview of all positions.

Non-liquid position tool (NLPT)

Activating assets not serviced by your bank

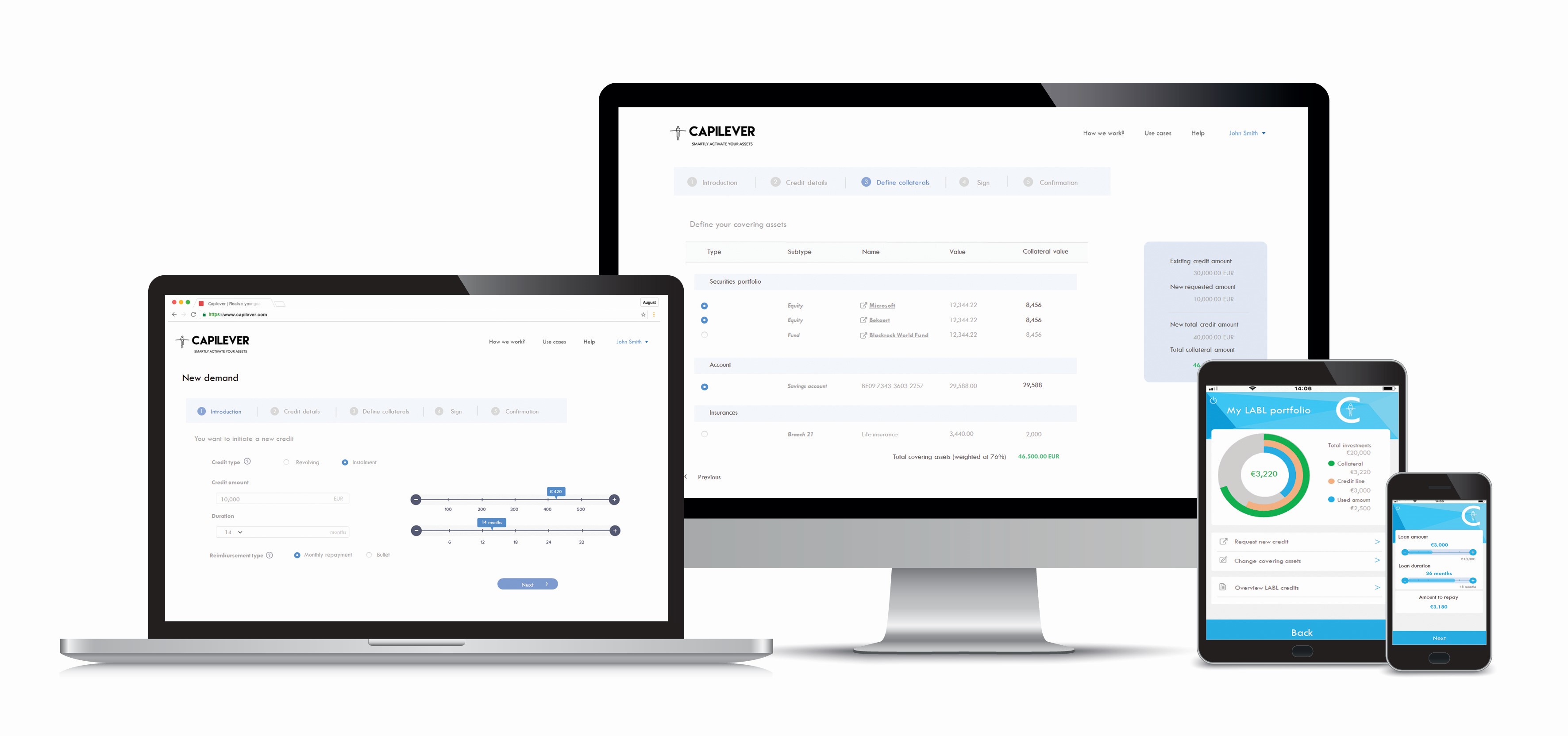

Our non-liquid position tool (NLPT) product provides an end-to-end solution for managing all customer’s assets, liabilities and off-balance positions not serviced by the bank. The solution allows bank employees and customers to keep track of all their non-liquid positions and associated transactions, supporting (semi-automated) valuations and providing a centralized overview of all positions.

What are customer benefits of NLPT?

Receive a full holistic reporting of all assets and liabilities, allowing to get a full overview of the customer’s wealth

Extent asset and collateral scope to (financial) products that are typically not present in current banking and PFM/BFM apps

Improved investment advice with investor profiling based on the customer’s complete financial situation

All assets of the customer can be used as collateral for the flexible and real-time asset based loans (see our LABL offering)

Through APIs assets are automatically updated on a constant basis providing an up-to-date valorization at all times

Customer benefits

- Receive a full holistic reporting of all assets and liabilities, allowing to get a full overview of the customer’s wealth

- Extent asset and collateral scope to (financial) products that are typically not present in current banking and PFM/BFM apps

- Improved investment advice with investor profiling based on the customer’s complete financial situation

- All assets of the customer can be used as collateral for the flexible and real-time asset based loans (see our LABL offering)

- Through APIs assets are automatically updated on a constant basis providing an up-to-date valorization at all times

WHAT ARE BANK BENEFITS OF NLPT?

BANK BENEFITS

- Generate new business of LABL loans. Instead of postponing acquisition or selling off their assets, customer can block increased collateral scope in a fully transparent and defensive way

- Increase customer retention as NLPT enables central depository of all wealth components

- Central dashboard and reporting allowing better informed advice to customer

- Avoid any personal Excel files and other unmanaged tools used by bank employees to keep track of important info on customers

- Provide a larger pallet of services to the customer (e.g. also management/advice on non-liquid products and added-value services like insurance, conservation, restoration…)

- Identify more cross-selling opportunities, i.e. a view on all customer’s assets and liabilities allows to provide additional services or products which customer doesn’t have yet or to provide more competitive offers for products/services customer has at competition

- Obtain better control on compliance issues and risk

A bank’s primary goal is to help its customers manage their money and associated risks. It can only do that by knowing the full financial situation of the customer in the best possible way. In current banking apps only a portion of the customer’s full wealth is managed, leading to incorrect advice and missed opportunities for both banks and their customers.

A bank’s primary goal is to help its customers manage their money and associated risks. It can only do that by knowing the full financial situation of the customer in the best possible way. In current banking apps only a portion of the customer’s full wealth is managed, leading to incorrect advice and missed opportunities for both banks and their customers.

INTEGRATE OUR APIs INTO YOUR DAILY BANKING APP

NLPT use case

Expanding and maintaining real estate patrimony

Michel is very active in real-estate. Michel invests all his savings in buying cheap houses, which he renovates and restructures in a number of apartments, which he rents out. All in all Michel has already acquired 4 houses, housing a total of 12 apartments. The total worth of these houses is €1,4 million and provides him a rental income of €8.000 per month. Michel would like now to place solar panels on all his 4 houses. This is an investment of €80.000 in total, for which he doesn’t have the necessary liquid money available.

Luckily his bank is an innovative bank, which offers the “asset-based lending” product, also on “non-liquid positions”. Michel inputs his 4 houses with necessary proof documents (like pictures and other official documents) in the tool and a valuation is made at a total of €1.4 million. At a haircut value of 90% the bank can offer him an ABL loan for €140.000 at around 2-2.5% interest rate. Michel decides to block 3 houses in the tool, which gives him a loan of €105.000, allowing him not only to do the solar panel investment, but also to install a heat pump on all 4 houses.

NLPT use case

Expanding and maintaining real estate patrimony

Michel is very active in real-estate. Michel invests all his savings in buying cheap houses, which he renovates and restructures in a number of apartments, which he rents out. All in all Michel has already acquired 4 houses, housing a total of 12 apartments. The total worth of these houses is €1,4 million and provides him a rental income of €8.000 per month. Michel would like now to place solar panels on all his 4 houses. This is an investment of €80.000 in total, for which he doesn’t have the necessary liquid money available.

Luckily his bank is an innovative bank, which offers the “asset-based lending” product, also on “non-liquid positions”. Michel inputs his 4 houses with necessary proof documents (like pictures and other official documents) in the tool and a valuation is made at a total of €1.4 million. At a haircut value of 90% the bank can offer him an ABL loan for €140.000 at around 2-2.5% interest rate. Michel decides to block 3 houses in the tool, which gives him a loan of €105.000, allowing him not only to do the solar panel investment, but also to install a heat pump on all 4 houses.

Ready to get Started ?

Happy to discuss your next Credit & Investment innovation project