We help bank customers better manage their liquidity and financial risks

We help bank customers better manage their liquidity and financial risks

Financial Needs (FINE) Software

Capturing your financial needs during certain moments in life

Single entry point towards the right financial solutions during certain key events in life

FINE sits before traditional product onboarding systems like loan origination

Financial Needs (FINE)

Capturing your financial needs during certain moments in life

FINE guides you towards the right financial solutions.

This new module sits before traditional loan origination within banks.

FINE Building Blocks

Determine

Need

Simulate

Costs

Define

Financing Need

Simulate

Affordability

Match

Best Solutions

Compare

Solutions

FINE Building Blocks

Centered Around Key Moments in Life

Centered Around Key Moments in Life

CAPILEVER Mission Statement

At Capilever we believe it’s the bank’s job to explain and deliver complex financial products and services in the simplest possible way and assist customers manage their liquidity and financial risks in the best and cheapest way

Our lending and investment tools are steps in the right direction for democratizing financial products, providing full wealth overviews and helping customers with the best financial solutions

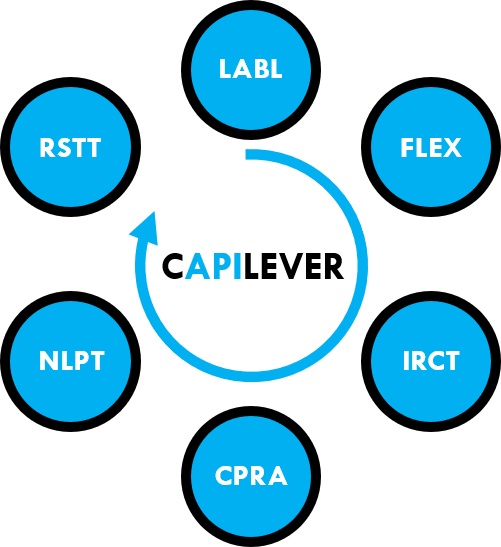

Services

Consulting services in the Credits and Investments space by a team of senior banking and IT consultants

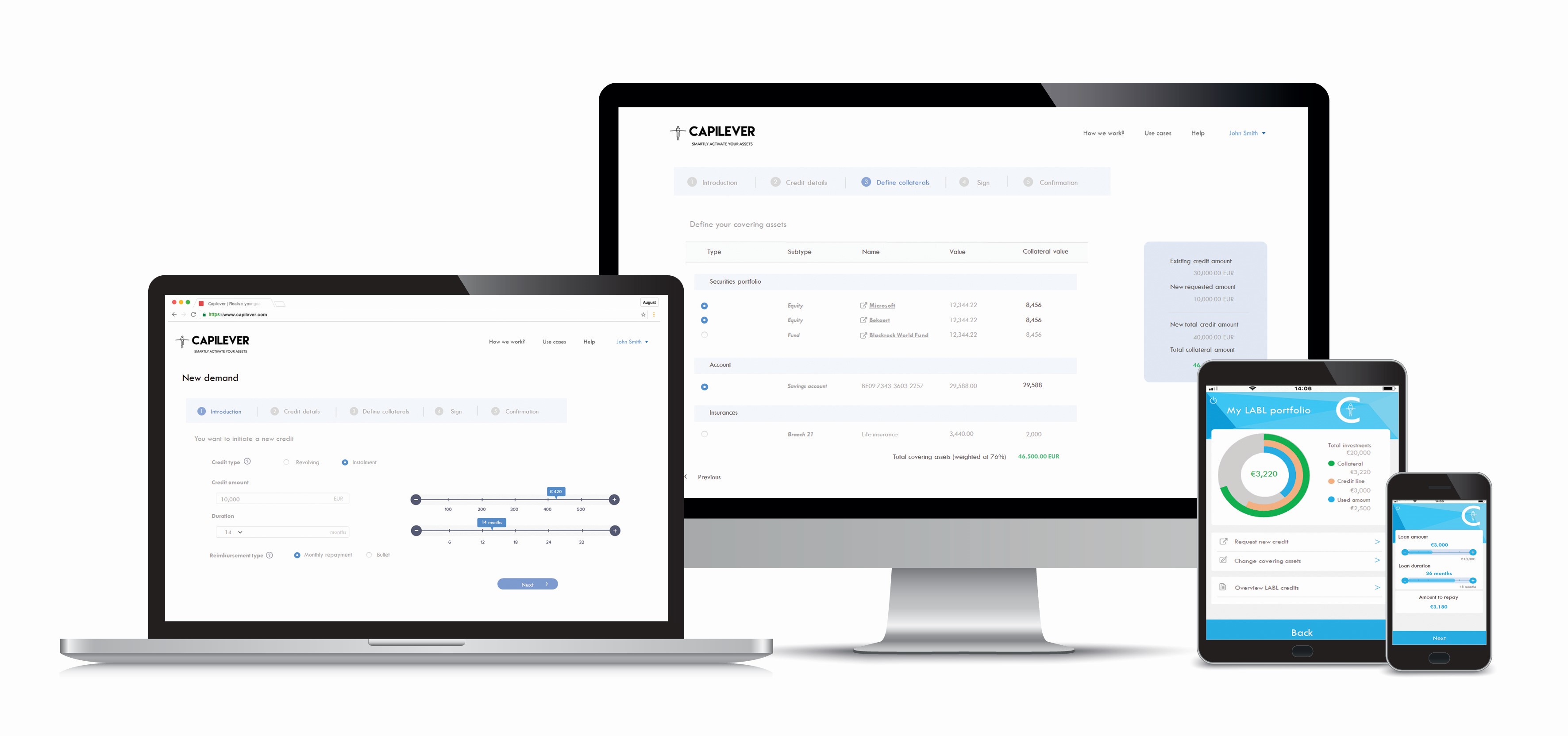

Software

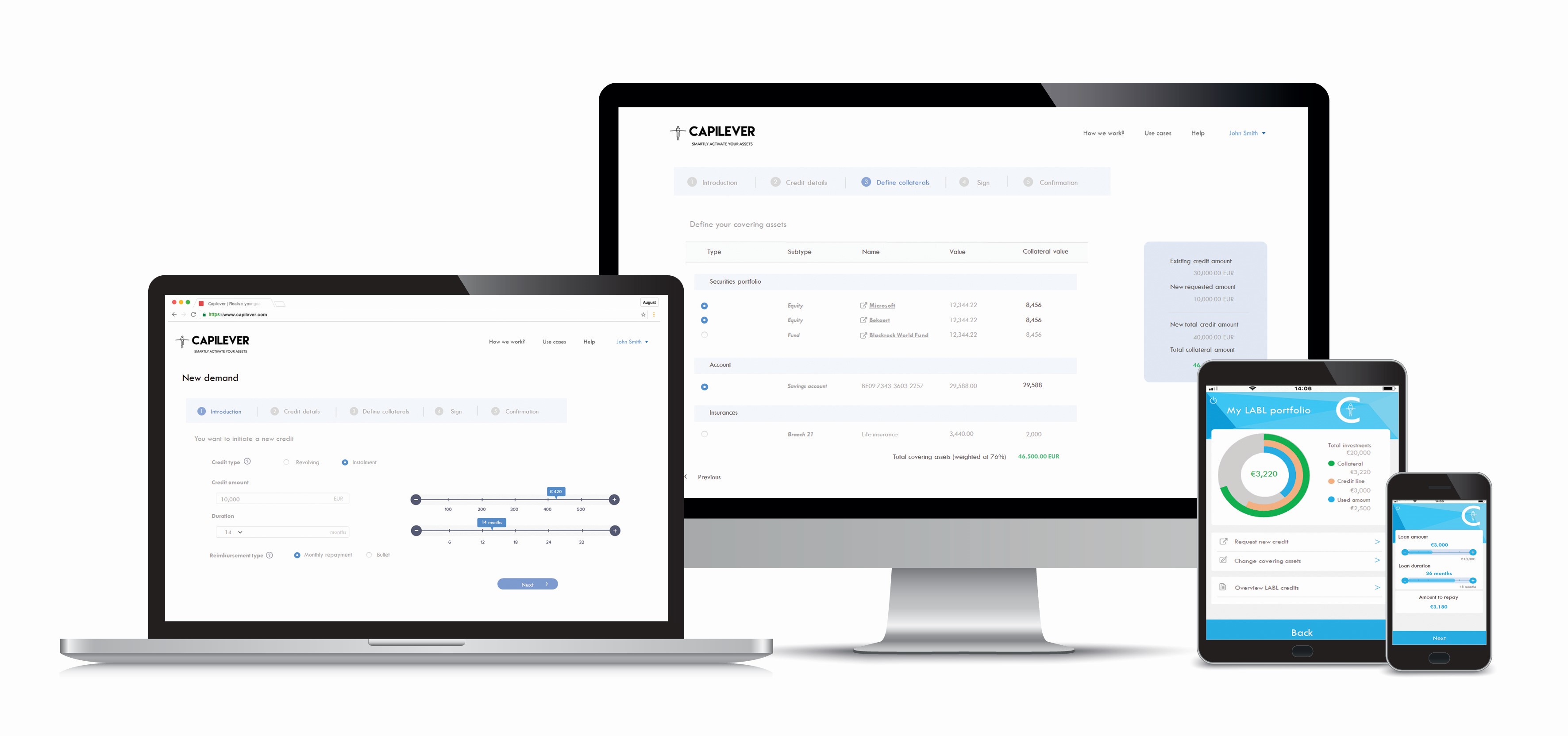

Building software for banks and insurers to assist their customers in better managing their liquidity and financial risks

Our products come with a number of well-defined APIs, which can be easily integrated

Mission Statement

At Capilever we believe it’s the bank’s job to explain and deliver complex financial products and services in the simplest possible way and assist customers manage their liquidity and financial risks in the best and cheapest way.

Services

Consulting services in the Credits and Investments space by a team of senior banking and IT consultants.

Software

Building software for banks and insurers to assist their customers in better managing their liquidity and financial risks.

Our products come with a number of well-defined APIs, which can be easily integrated.

Our Other Software Products Supporting Your Financial Needs

Our Other Products Supporting Your Financial Needs

Want To Know More ?

Want To Know More ?