Counterparty Risk Assessment (CPRA)

Manage, share and enhance counterparty financial risks

For SMEs, often not having lots of reserves, trusting the wrong customers can be a disaster. At the same time, customers also want to avoid making deals with fraudulent or malicious companies (SMEs). For example, doing a renovation with a building contractor, which is close to bankruptcy or even worse which is fraudulent.

Counterparty Risk Assessment (CPRA)

Manage, share and enhance counterparty financial risks

For SMEs, often not having lots of reserves, trusting the wrong customers can be a disaster. At the same time, customers also want to avoid making deals with fraudulent or malicious companies (SMEs). For example, doing a renovation with a building contractor, which is close to bankruptcy or even worse which is fraudulent.

What are customer benefits of CPRA?

SMEs can better assess if they want to accept or not a specific job, based on the financial steadiness of a customer. If needed, they can adjust their pricing, to compensate for extra counterparty risk

Customers can do a check if a professional / company is to be trusted both from a social as from a financial perspective

SME can generate more revenue as it can showcase to customers its financial stability and good feedback from customers

Improved financial advice from bank, based on information collected in the CPRA tool

Customer benefits

- SMEs can better assess if they want to accept or not a specific job, based on the financial steadiness of a customer. If needed, they can adjust their pricing, to compensate for extra counterparty risk

- Customers can do a check if a professional / company is to be trusted both from a social as from a financial perspective

- SME can generate more revenue as it can showcase to customers its financial stability and good feedback from customers

- Improved financial advice from bank, based on information collected in the CPRA tool

WHAT ARE BANK BENEFITS OF CPRA?

BANK BENEFITS

- Extra service to customers. Potentially service can even be monetized by asking commission to SMEs

- Strong customer retention. Leaving the bank would mean they cannot share their financial counterparty score anymore with customers

- Allows to generate extra revenues, via financial products improving financial risk profile

- Interesting info collected from customers (e.g. votes) for KYC purposes, improved financial advice and credit risk scoring

The CPRA offering is part of our vision at Capilever that banks should help their customers optimally manage their financial risks. One of the main financial risks is counterparty risk, for which banks provide very little services at the moment. The CPRA tool of Capilever provides a solution for better managing counterparty risk.

The CPRA offering is part of our vision at Capilever that banks should help their customers optimally manage their financial risks. One of the main financial risks is counterparty risk, for which banks provide very little services at the moment. The CPRA tool of Capilever provides a solution for better managing counterparty risk.

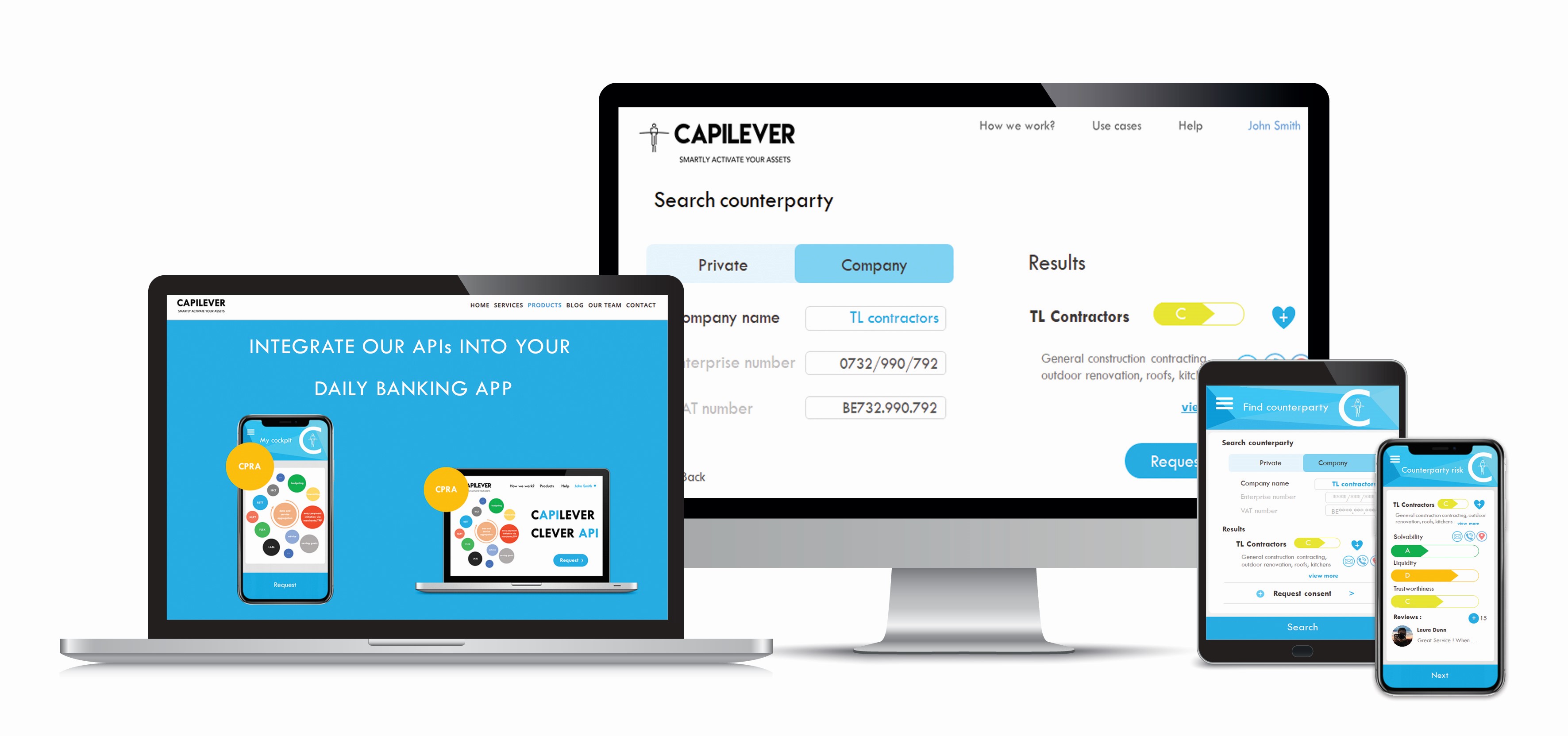

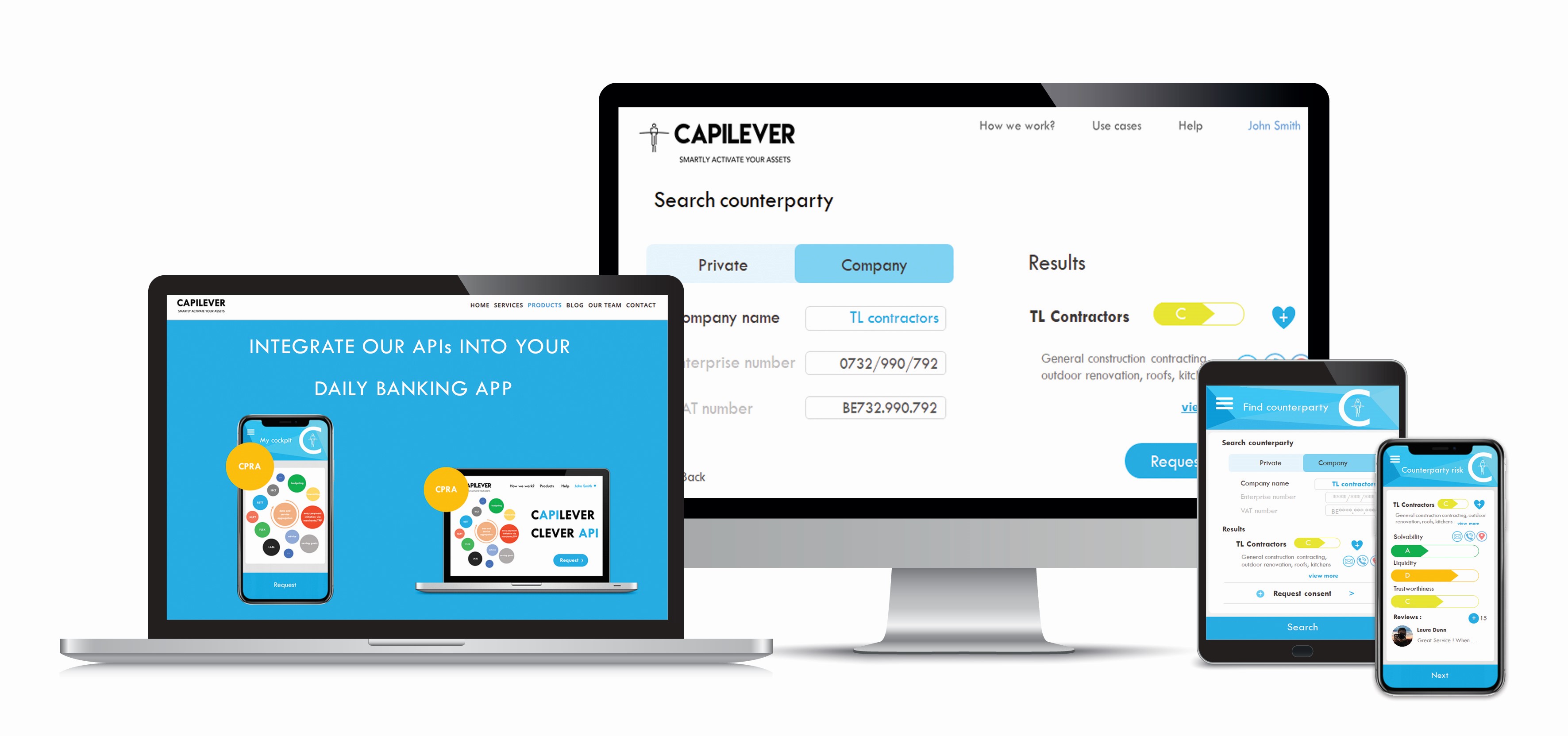

INTEGRATE OUR APIs INTO YOUR DAILY BANKING APP

CPRA use case

Diane wants to renovate her house and found a few possible contractors, but doesn’t know if they can be trusted

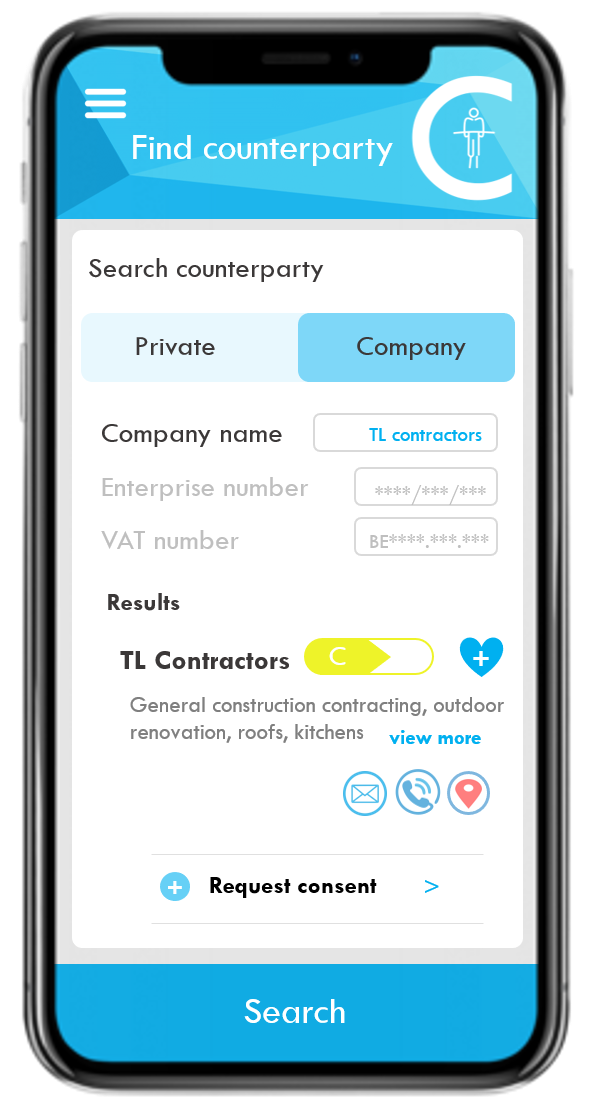

Diane wants to renovate her house. Via a website to find building contractors, she has received 3 offers from contractors. Prices are quite similar, but Diane doubts about the trust worthiness of the 3 contractors. Luckily Diane’s bank offers the CPRA tool of Capilever.

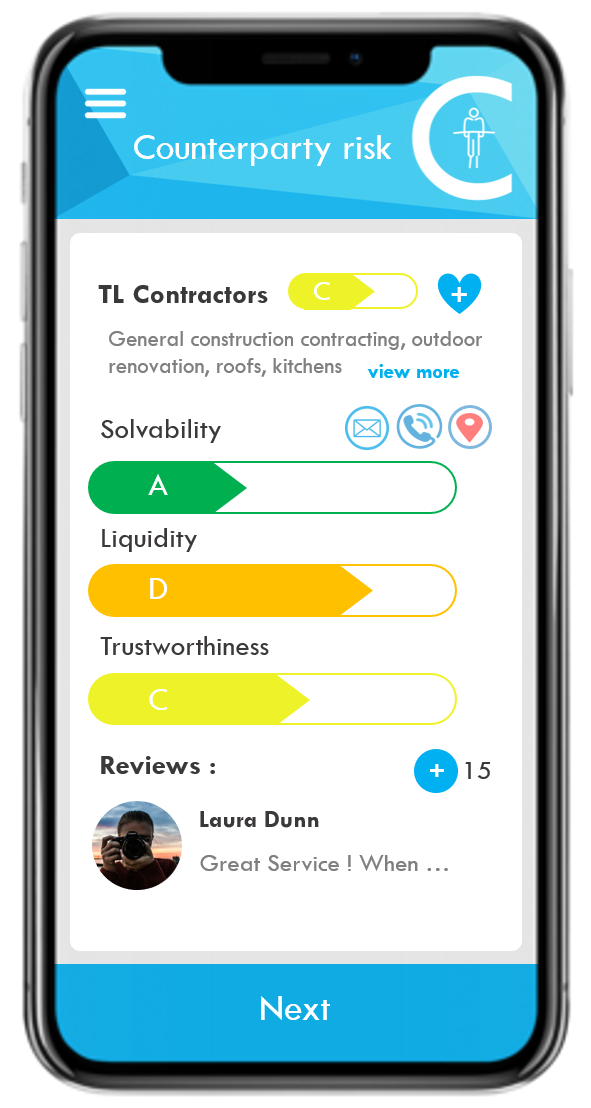

Diane logs on to the bank online tool and looks up the 3 contractors. 2 out of the 3 contractors are indeed customer of the bank and use the CPRA tool. Both contractors have however restricted access to their financial risk profile (not public for everyone), so Diane sends a request for consent to see their financial profiles. A few hours later 1 of the 2 contractors has accepted the consent request. Diane sees that this contractor is financially very sound and furthermore has 3 very positive feedbacks of customers also using the CPRA tool. Diane is convinced that this contractor is a good choice and accepts the offer.

After 3 months, the renovation is successfully finished. Diane is very satisfied about the contractor’s work. The contractor asks to give a positive feedback. Diane logs on to the online banking tool and goes to the CPRA tool. Diane selects the contractor and gives a very positive feedback. As proof of transaction, Diane uploads the bill and some pictures of the renovation. This information is only visible to the bank and to the contractor, but can be used in case of debate of the trustworthiness of the feedback.

Diane wants to renovate her house and found a few possible contractors, but doesn’t know if they can be trusted

Diane wants to renovate her house. Via a website to find building contractors, she has received 3 offers from contractors. Prices are quite similar, but Diane doubts about the trust worthiness of the 3 contractors. Luckily Diane’s bank offers the CPRA tool of Capilever.

Diane logs on to the bank online tool and looks up the 3 contractors. 2 out of the 3 contractors are indeed customer of the bank and use the CPRA tool. Both contractors have however restricted access to their financial risk profile (not public for everyone), so Diane sends a request for consent to see their financial profiles. A few hours later 1 of the 2 contractors has accepted the consent request. Diane sees that this contractor is financially very sound and furthermore has 3 very positive feedbacks of customers also using the CPRA tool. Diane is convinced that this contractor is a good choice and accepts the offer.

After 3 months, the renovation is successfully finished. Diane is very satisfied about the contractor’s work. The contractor asks to give a positive feedback. Diane logs on to the online banking tool and goes to the CPRA tool. Diane selects the contractor and gives a very positive feedback. As proof of transaction, Diane uploads the bill and some pictures of the renovation. This information is only visible to the bank and to the contractor, but can be used in case of debate of the trustworthiness of the feedback.

Ready to get Started ?

Happy to discuss your next Credit & Investment innovation project