Understanding your customer’s financial needs is the cornerstone of customer centricity

7 July 2021

“It’s all about me, here and now” can be considered as the catch phrase for customer centricity. In the banking industry this means providing financial services 24/7 via any channel (including third party apps via embedded banking) and as personalized as possible.

However, in reality many banks are still organized in a product-centric way. They are often limited by technical constraints (like overnight batches which hurt the application availability, or different channels not using a common real-time API layer making cross-channel continuation nearly impossible) and have difficulties exploiting – in a holistic way – the vast amounts of customer data captured by the different systems. As a result, many banks currently do not deliver a great customer-centric experience.

Most banks bank are aware of this threat (or rather opportunity) and are taking necessary actions. However, many banks immediately start exploring setups equivalent to the bigtech players. While it is good to be ambitious, it is also important to learn to walk before you run.

From solely product-centric to customer-centric or hybrid approach

Instead of trying to immediately implement complex real-time customer analytics, allowing to predict the next action of the customer (requiring the setup of complex data architectures with complex AI algorithms), it might be easier to first start asking customers about their real needs. Often customers do not exactly know this and welcome some guidance. Furthermore, contrary to the retail sector, financial services should be less about impulsive buying actions, but more about well-thought-out decisions as they typically result in long-term engagements with the bank. This means that some kind of “pause” moment (friction) to determine the customer’s needs can actually be beneficial for the long-term customer relation.

Obviously such a questionnaire/dialogue should be as fluent and engaging as possible, which can be done via dynamically generated questions, chat bots, gamification techniques and intuitive wizards and simulators.

This presented phased approach allows delivering improvements in customer-centric journeys in shorter timeframes. In addition it allows gaining expertise and structured data about the customer, which considerably increases the model success rate for predicting the customer exact needs.

We propose the following 4-step gradual roadmap:

- In a first phase, banks switch from or expand their product-centric sales approach (presenting customers with different products and letting the customer decide) to a more customer-centric sales approach, starting from the customer needs. This is captured by a simple static questionnaire.Banks can also opt for a hybrid model where customers can decide themselves to start from a product (product-centric) or from a need (customer-centric).

- In a next step this evolves towards dynamic questionnaires, where questions depend on pre-defined rules, which take into account the customer characteristics and previous answers.

- After that, these dynamic questionnaires evolve automatically based on Machine Learning in order to ask the most relevant questions first.

- And these ML models evolve towards predicting the customer needs, based on real-time data captured about the customer (like their financial transactions, the type of webpages they visit, their geographic location, etc.) and matching this data with patterns identified in the full customer data sets. This allows identifying the financial needs of the customer without them having to explicitly express these.

Independent of how the financial need of the customer is captured, it has to be translated into a product (or package of products), which best fits this need. It is equally important to justify the proposal, by providing a qualitative and potentially quantitative comparison with other propositions. The comparison could even include What-If simulators calculating the impact of certain product choices, like what-if interest rates rise/drop, what-if I get divorced, what-if I lose my job, etc. Ultimately these comparisons should convince customers that the bank is offering the best product for them, and not necessarily for the bank. Once customers are convinced of this, they can easily be redirected to the traditional product origination flow, where a lot of information can be prefilled with data provided in the needs questionnaire, provided just before or even in the past.

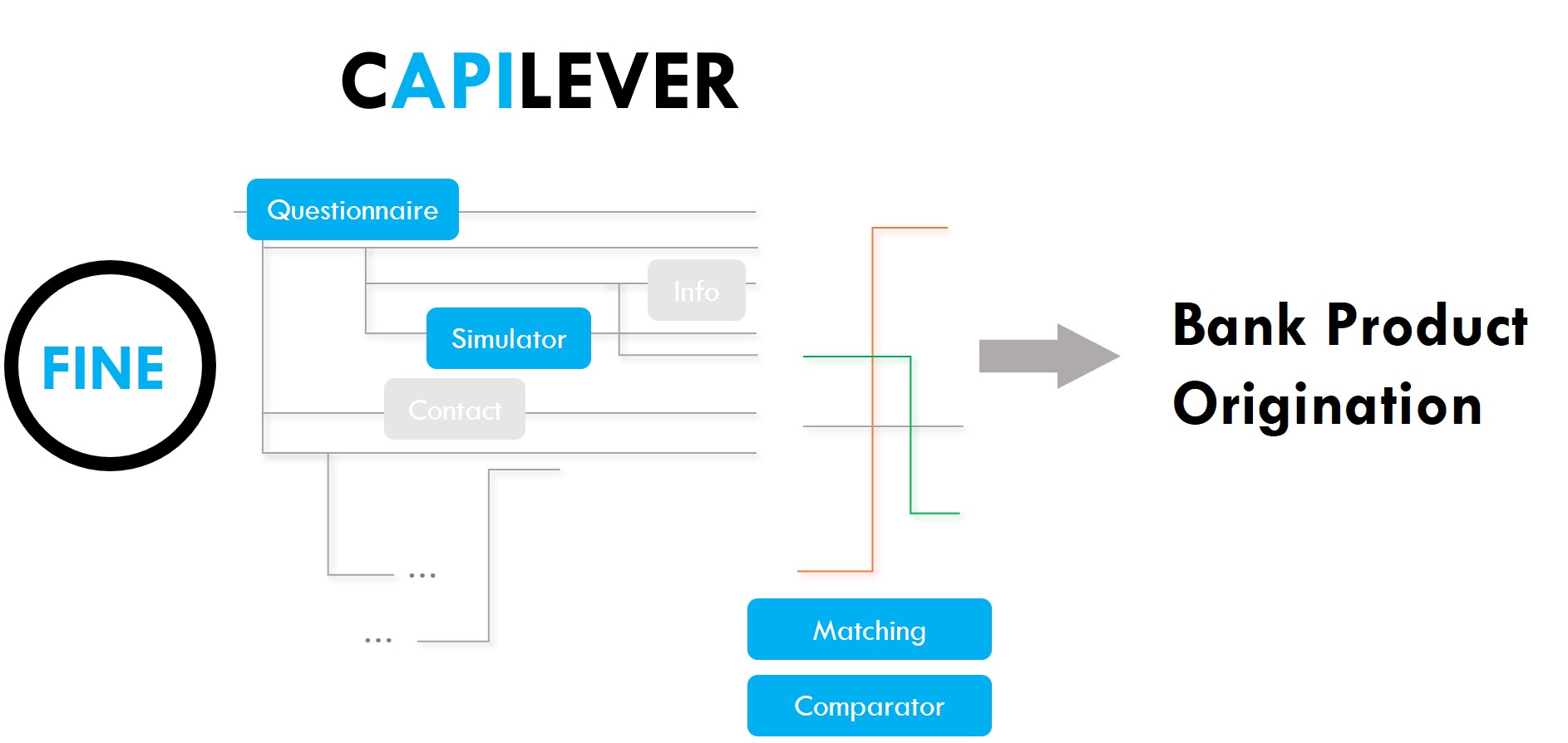

Capilever’s FINE module provides a packaged, but highly configurable solution for capturing customer needs in the financing (credits) domain. It comes with a dynamic questionnaire, several relevant simulators, a product matching algorithm and a comparator for the proposed solutions. This way banks can evolve very quickly to a customer-centric flow with minimal effort.

Are you ready to define together your customer’s needs?