Credit servicing – Much more than just a back-end process

5 June 2020

In our last Capilever blog “Credit origination – A lot of evolution on the horizon” we already introduced the different steps and modules involved in a credit origination process, i.e. from simulation and demand input to credit analysis and decision, all the way up to contracting.

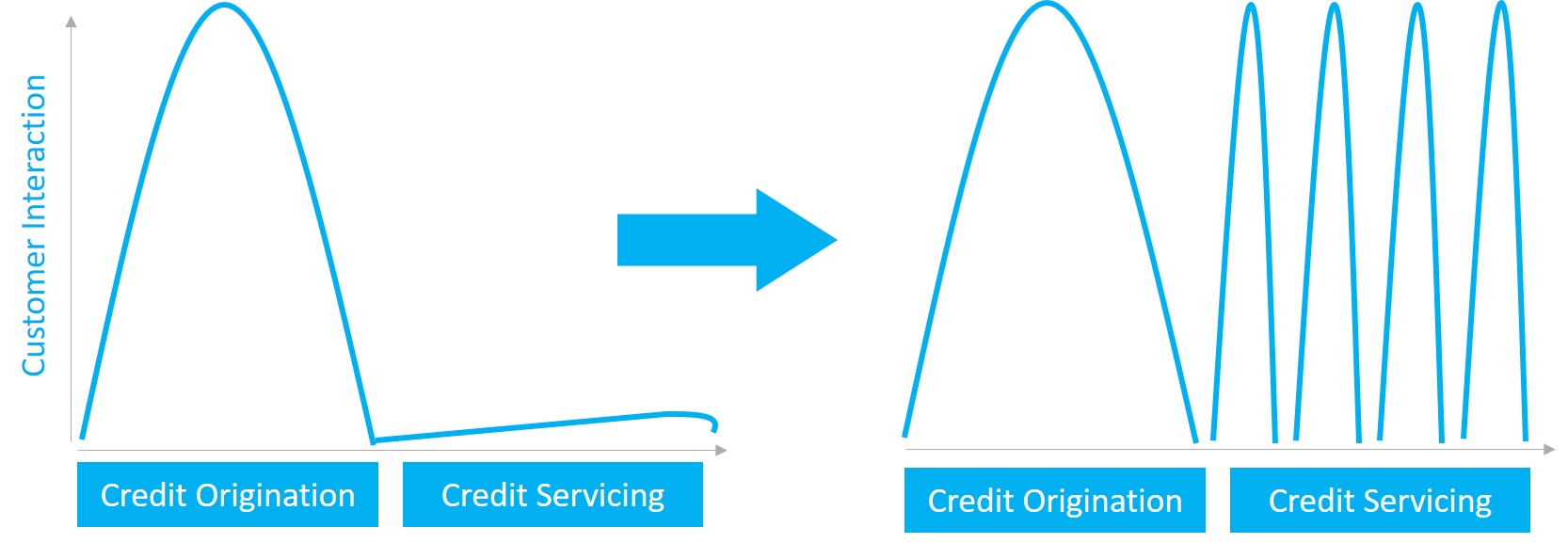

While credit origination is considered as a very customer-centric process, the credit servicing part that comes afterwards is usually considered as a purely operational, back-end process. At Capilever we believe however that a more customer-centric approach in the credit servicing lifecycle can bring considerable added-value and competitive advantage. In our Capilever post “Are credits not too commoditized?” we already mentioned that banks should come up with new value-added services on top of a running (active) credit, like a much more flexible way of reimbursing the credit, automatic suggestions to rewrite a credit… These value-added services mean that banks should foresee much more (possible) customer contact-points during the loan duration.

Obviously today most credits allow already several servicing requests, but most of these servicing requests are handled manually (usually not supported by the online banking platform, but manually inputted by a branch employee or even someone in the mid- or back-office). Some examples are:

- Update the credit feeding account, i.e. modify the account used to do the (monthly) repayments

- Early Repayment, i.e. a partial or full early repayment of the credit amount

- Adapt the involved parties linked to a credit, i.e. add or remove a party acting as a borrower of the credit. This will typically happen in case of marriage, divorce or decease of one of the involved parties.

- Increase or decrease the duration of a credit. A typical example is the prolongation of a bridge loan.

- Adaptation of interest rate of a credit, i.e. customer wants to renegotiate his credit interest rate (when market interest rates have dropped significantly or when customer’s financial situation has significantly improved).

- Mortgage transfer, i.e. change the asset in an existing mortgage: client who buys a new house and who wants to transfer his existing mortgage from his old house to the new house, while keeping the same mortgage collateral.

- Deliver ad-hoc fiscal attestation, i.e. allow customer to request a duplicate of the delivered fiscal attestation.

Apart from those requests initiated by the customer, there are also a number of servicing actions, which are happening (automatically) according to the credit contract but allow an interesting contact point with the customer for financial optimization and cross-selling. For example:

- Automatic adaptation of interest rate in case of a variable interest rate loan. This event can be an interesting moment for the bank to offer the possibility to increase or decrease the duration of the credit, in order to allow reviewing the new monthly reimbursement amount.

- Delivery fiscal attestation delivered by the bank for tax deduction

- Closure of contract at end date, i.e. when the credit is fully reimbursed, the credit will be closed. This can however be an interesting moment to congratulate the customer, propose solutions to use the freed up monthly reimbursement amount in investment products, but potentially also pay out a bonus to the customer, when he successfully repaid a loan without any payment issues during course of the loan (i.e. reward good customers).

Independent of whether a service event is triggered manually or automatically, this event should be an attractive and compelling user experience and should best be handled fully online.

This means following features should be foreseen:

- Notify customer of any automatic event (upfront and at the moment itself)

- Allow customer to trigger a manual service request easily in different online channels and provide cross-channel continuation

- Allow to immediately simulate the impact of a possible change to the credit (e.g. show the new reimbursement amount and impact of total paid interest and total reimbursement amount, when changing duration of a credit)

- Proactively be informed when certain service requests might be interesting. E.g. propose to increase reimbursement amount (and thus decrease credit duration) when maximum fiscal deductible amount no longer filled or when financial situation of person clearly allows a bigger repayment.

- Digital signing and contracting of any service request

- …

Such a digital credit servicing cannot only reduce operating costs (by automating more and moving more work to self-service), but can also improve relationship with the customer, which will also have a positive effect on the sales of other credits and other financial products. Clearly a good digitalization and excellent user experience in the credit origination process is the first priority, but once this objective is reached, banks should tackle the credit servicing requests as well.