Are credits not too commoditized?

25 Feb 2020

Since 1 July 2007, the Belgian electricity market has been liberalized. While in the first years, only few consumers switched electricity provider, this has reached a new high this year. In the first 9 months of 2019, already more than 500.000 Belgians (on an 11 million population) have switched electricity provider. Incumbent providers still try to convince customers with product-differentiation slogans that they offer the best reliability or the greenest electricity. The truth is that electricity is a commodity product, with little to no differentiation in the offered product between providers. The only distinction that can be made is based on price and a little bit on service level. However, these offered services, for example linked to onboarding at the provider or the way they invoice, have also become so commoditized – thanks to digitalization – that differentiation on that front has also disappeared.

Furthermore comparison websites and platforms organizing group purchases and automatic switching based on a continuous analysis of your electricity invoice, are facilitating the competition and the switching of consumers even more.

In other words the market has become fully commoditized and price has become the only differentiator.

It’s interesting now to make the analogy with the banking sector. For many banking products the financial services sector tries to innovate, by providing all kinds of innovative services which avoid the commoditization of these products.

For example:

- Daily banking offering various extra services like PFM, saving goals, an ecosystem of partnerships with external parties (like buying public transport tickets, paying for parking, etc.), different payment methods, fancy apps, etc.

- Investments featuring new value-added services like robo-advise, complex portfolio management features, risk calculations, etc.

- Insurances providing new products like usage-based insurances and value-added services on top of the insurance like gamification, easier claim handling process and ways to avoid insurance claims (like e.g. health features linked to a health insurance)

- Leasing providing platforms to acquire the product on which a financial leasing is taken

The only banking domain for which such value-added services are not really available is the “Credits” domain. This does not mean that there is no innovation happening for credits: the origination process is becoming more digitized and the scoring engines are becoming more complex (often using AI techniques). But, once the user experience for originating a loan is fluent at most banks (which is already nearly the case for consumer credits) the product will have become fully commoditized.

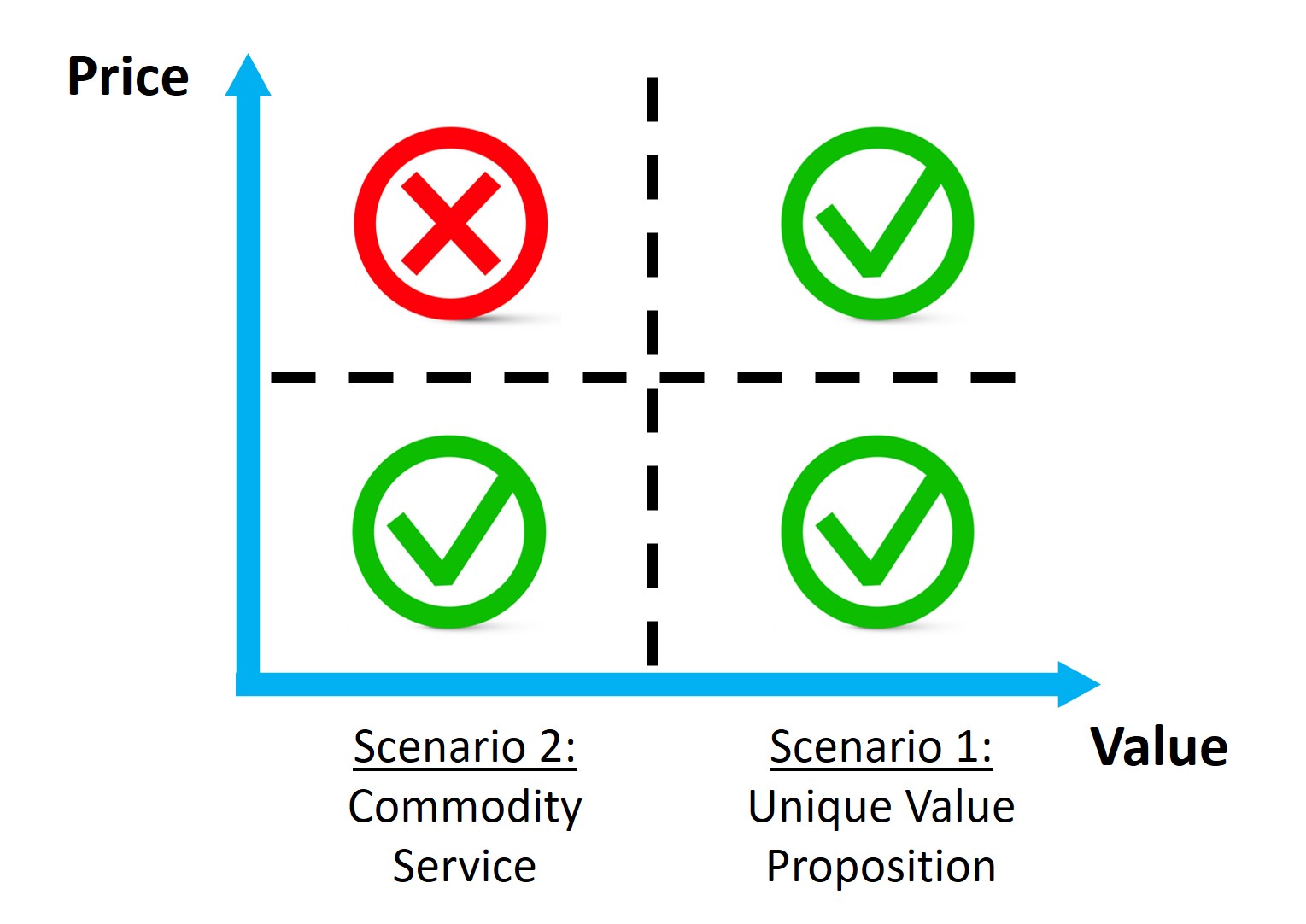

There are 2 options: either (1) banks come up with new value-added services on top of a running credit, or (2) they accept that a credit product becomes commodity, for which consumers will switch between providers almost exclusively based on price.

In the first scenario (“differentiation based on value-added services”) we could think of new credit-linked services like:

- A much more flexible way of reimbursing the credit, i.e. instead of a fixed monthly payment, the bank could allow a flexible repayment. For example where the client manually adjusts the monthly repayment amount based on their current financial situation or based on robo-advise and simulations using expenses and budgeting plan information available in PMF tools. These simulations then help forecast and achieve the monthly capacity to reimburse. Currently, repayment methods (monthly fixed, inflation linked, bullet, balloon, etc.) are chosen at the start of the credit, but it would be interesting for customers if they can adapt the way they repay during the life-time of the credit under certain conditions (cfr. the Capilever’s FLEX product)

- Linked insurance products, which pay the monthly reimbursement for you, when you are ill or lost your job

- Ability to use liquid assets at the bank as collaterals for better interest rates or even use assets at other banks or non-liquid assets as collaterals (cfr. Capilever’s LABL and NLPT products)

- Automatic suggestions to rewrite your credit, when the central bank interest rates drop and the gain of rewriting is larger than the administrative cost (penalty) for rewriting

- More flexible ways for increasing / decreasing the duration of the loan (continuously over the course of the credit)

- Easier possibilities to reuse open mortgages, for example when the mortgage inscription period is longer than the mortgage loan (then the customer can still use the remaining period for opening credits), or when the outstanding credit balance becomes significantly lower than the mortgage inscription amount

In the second scenario (“commodity with differentiation based on price”) banks should prepare for a cost optimization and increased transparency to their customers. Like for the electricity providers, where certain (inattentive or uninformed) customers are locked into very badly priced contracts, there is a large group of customers that still has a mortgage with very high interest rates, as they have never made the effort to rewrite the loan or consider another bank. Just like in the electricity sector, the Fintech comparators will become more and more sophisticated. There are already some credit comparators like Bankrate.com, Nerdwallet, Comparethemarket.com, Finder, Credible, TopCompare, Spaargids.be, Hypotheekwinkel, Bankshopper, etc., but they are still quite immature. Typically, they only compare the market prices and not the individualized pricing offers and focus only on new credits being originated. Very soon, these comparators will also evolve in full end-to-end service tools (cfr. Capilever’s IRCT tool), which continuously monitor all existing credits and check if a full reimbursement and rewrite at another bank is not cheaper (considering the customer’s personal information, which is impacting the credit scoring and pricing).

Banks better be prepared for this evolution, by either offering more personalized credit products with excellent value-added services or by becoming the cheapest. The time a customer automatically opens a loan for 25 years at their main bank and repays it without any reconsideration for the whole duration will soon be in the past.