Being unique is not enough – how to assess the impact of a new banking solution

24 Oct 2019

Repeating and improving what others have successfully done is a great and proven way to be successful when starting a new business. It’s not what we want to do at Capilever.

Our mission is to bring real innovative lending and investment products to banks and their customers. Automating the online demand process for a new loan, for example, is crucial and necessary in this new digital age, but it’s not innovative anymore. Innovation means bringing something new, and what’s new is often unique. Some ideas just remain unique without real market traction because we find out – ideally after some market research – that they have no real business impact. However other unique ideas form the basis for great new business models. We need unique ideas to stand out of the crowd and continuously surprise our customers.

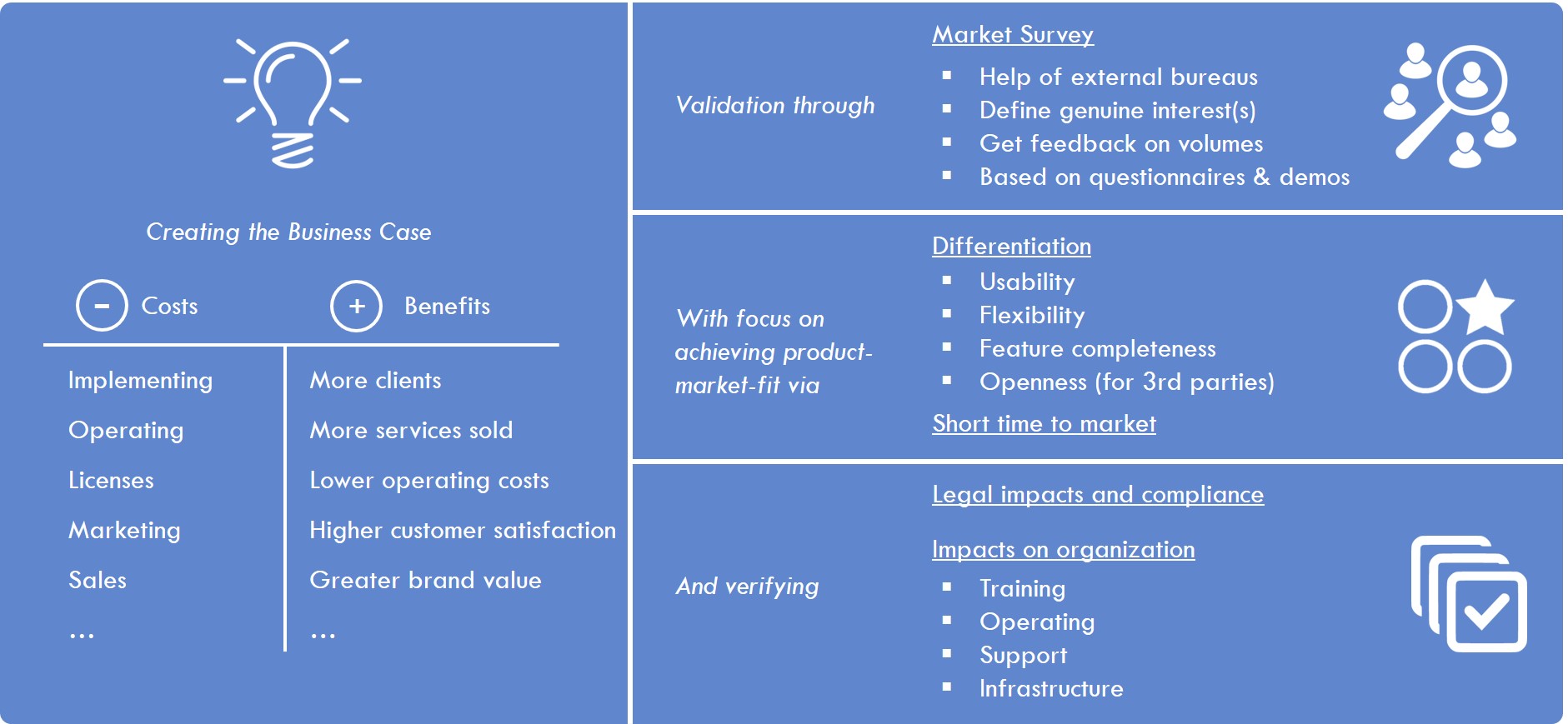

When positioning a new solution, banks first have to analyse the business case, i.e. compare the costs of implementing, operating, marketing and selling the new product or service versus the increased revenues and reduced costs (directly measurable) and increased customer experience and brand value (indirect and hence more difficult to measure). As banks have the critical mass of their large existing client base, the cost of marketing the new solution is typically lower than for a new start-up positioning the same product or service. Principal costs are linked to integrating the new solution (through APIs) with the rest of the banking applications and technically / functionally supporting and operating it.

Before banks jump headlong into rolling out a new innovative solution they should perform a thorough market research with or without the help of external firms. Or in some cases a market study has already been done by the partner vendor. It’s crucial to find out whether there is a significant interest in the market and what exactly customers are looking for. This can be achieved through mock-up screens or demos of the most important features that are presented to the target audience.

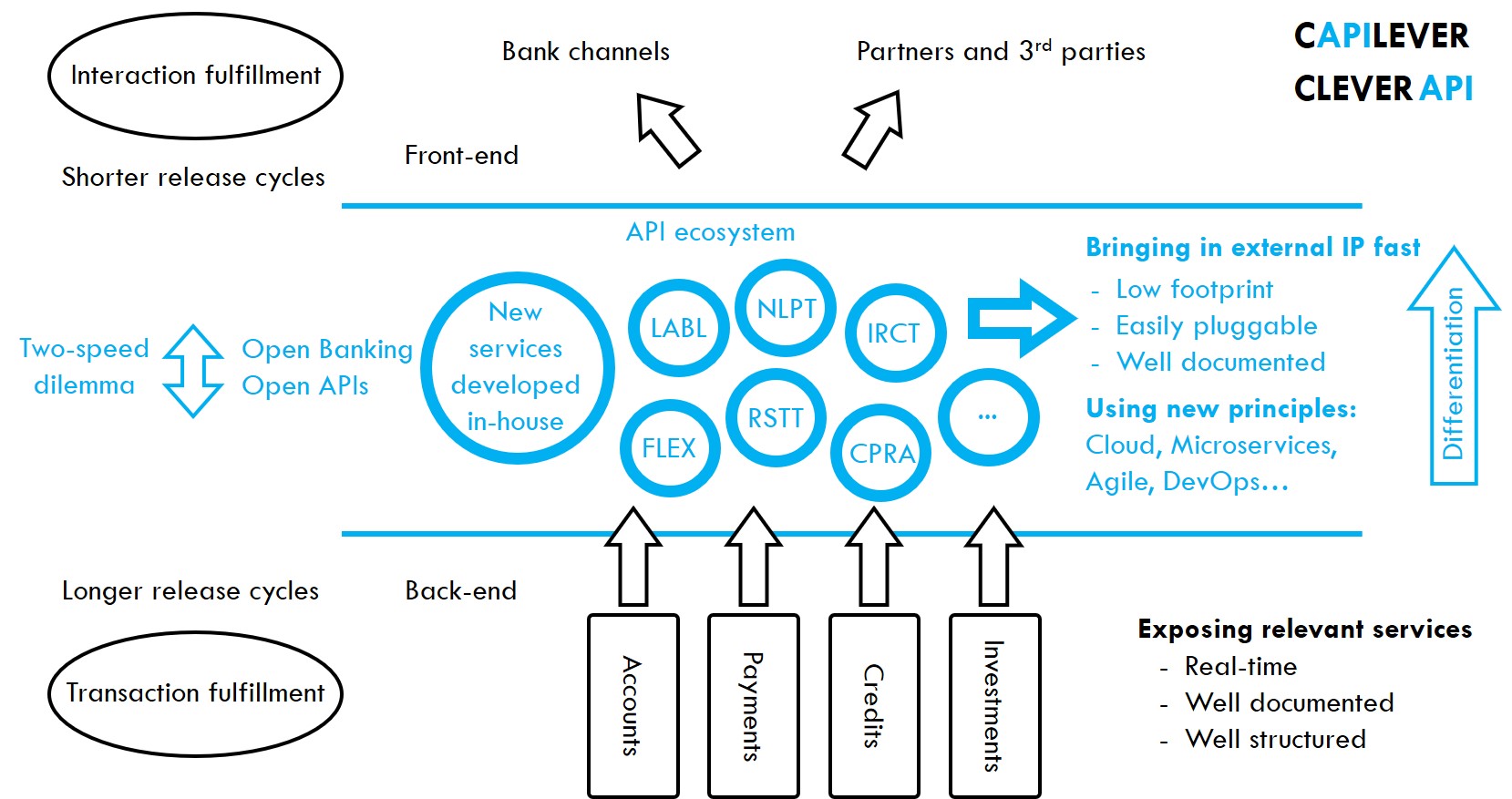

A key measure of success is the extent to which the new offering allows the bank to differentiate from competition. Equally important is the ability to bring the solution fast to market to stay ahead. Thanks to open architectures, banks can plug in third-party (with expertise and IP in a specific domain) innovative software packages and SaaS solutions fast. Technically rolling out the new solution is quite similar to other projects that banks have performed before, except that novel solutions in the client engagement space are typically evolving faster requiring shorter release cycles. This means principles like micro-services, DevOps, cloud and Agile are becoming essential for both banks and their providers. Thanks to novel deployment techniques these new low-footprint solutions are easily pluggable and compatible with the bank’s architecture, provided that the back-end exposes the necessary real-time services in a well-structured and well-documented way.

In today’s very regulated financial market, legal advice needs to be sought for researching the regulatory and legal consequences and constraints for the new solution. For example, is the new offering in line with consumer protection laws, does it respect data privacy and GDPR, does it not put pressure on the bank’s capital constraints, etc. In addition, partner vendors can develop and test their solutions against regulatory sandboxes that are becoming more commonly used.

Before rolling out the new solution it’s important the bank staff gets trained and understands how it could impact their existing operations. This could concern the call centre (1st line support), application owner(s), infrastructure support (hosting), etc.

Banks are in the driving seat for offering more creative and novel solutions around financing and wealth. External players are coming to the forefront, but still require the link with the bank systems. In addition, banks have the long-term trust with their customers, which is crucial in offering certain new sensitive services. Finally, banks need to make sure that their end customers experience as little friction as possible.