Why lending against your investments is perfectly compatible with daily banking and PFM/BFM offerings

18 July 2019

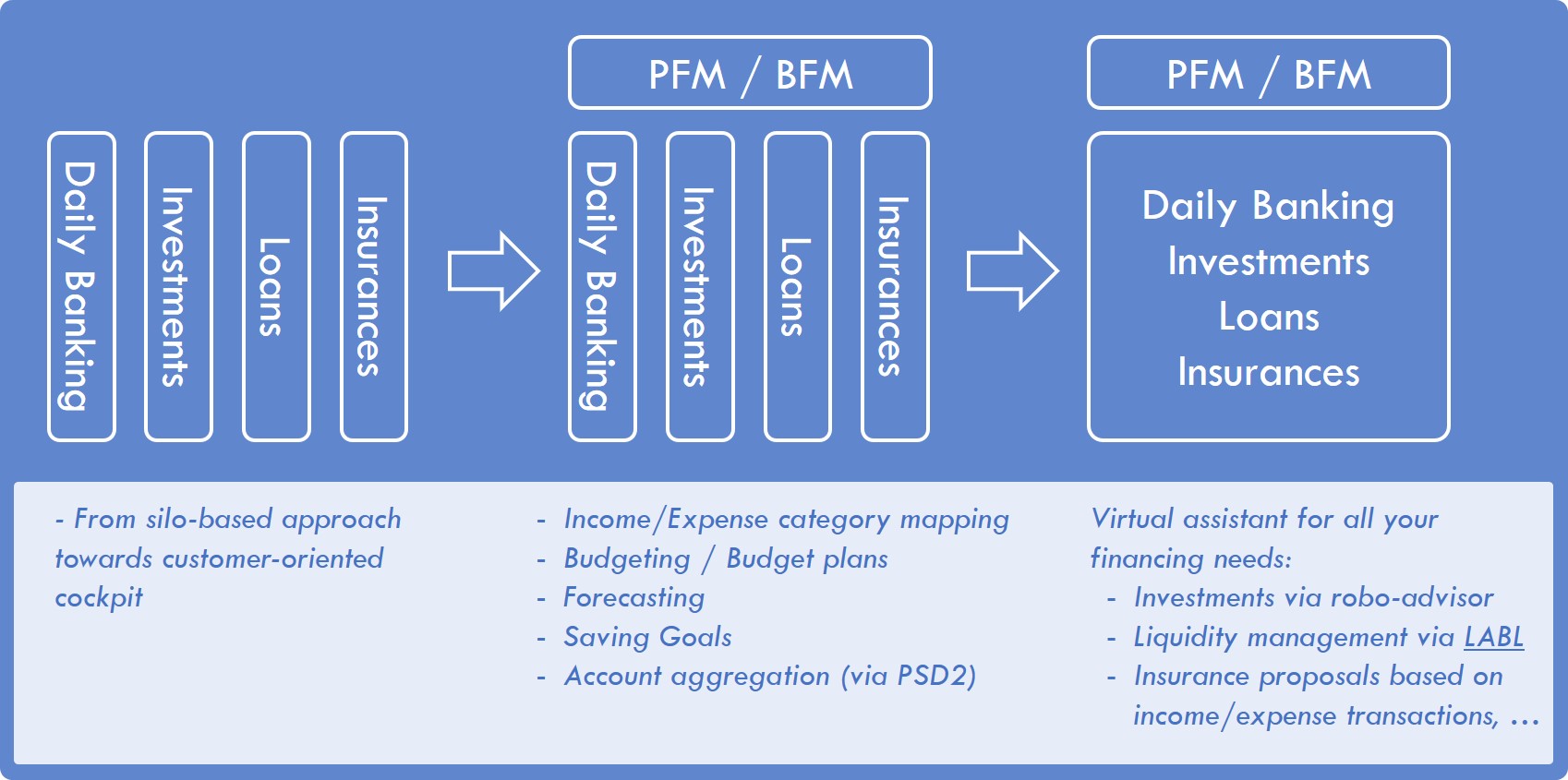

Today’s bank customers want a fluent, end-to-end experience. Unfortunately most online and mobile banking platforms are still very silo organised, with typically modules for Daily Banking, Investments, Credits and Insurances. Even though this reflects very well the internal (IT) organisation of the bank, customers prefer to have a more customer-oriented cockpit, where they can manage end-to-end solutions and not banking products.

Many banks have therefore started to implement PFM (Personal Financial Management) and BFM (Business Financial Management) solutions, which form a first step in this direction. Despite significant efforts, most of these implementations have however led to disappointing adoption rates and revenues not fulfilling their promises. Our belief is that a lack of integration between the different product silos is at the core of these setbacks. At most banks these PFM/BFM solutions form a thin layer on top of the existing products, but in the end the customer still has to interact with the same banking products.

From silo-based approach to customer-centric cockpit, with new value-added services for daily banking and PFM/BFM offerings. LABL is perfectly compatible with the innovation roadmap for these PFM/BFM solutions.

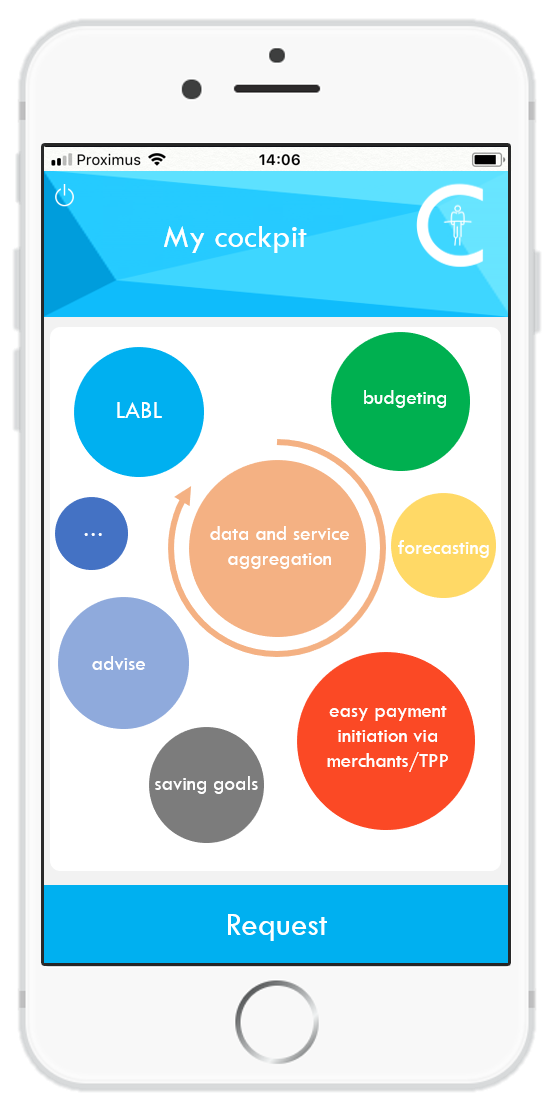

A service, which perfectly bridges these silos and suits very well with the customer journey is our Liquid Asset Based Lending (LABL) product. Wouldn’t it be great if your PFM/BFM solution identifies in real-time a lack of liquidity and automatically generates liquidity in a cheap way? This could be achieved via the LABL product. Once the customer has opened a framework agreement, he can block a number of long-term assets to serve as (future, currently unused) collateral for LABL credits. Whenever the PFM/BFM solution identifies a liquidity issue, this buffer can be consumed as a collateral for an automatic and real-time opening of a LABL credit to resolve the liquidity need. Such process takes away the burden of liquidity management from the retail client or company, which is exactly what customers desire from their financial institution, i.e. when customers have sufficient assets let the bank automatically take care of optimizing any unmatching terms between assets and liabilities.

Thanks to this flexible, real-time and cheap way of financing, customers can hold much less money in their saving accounts. Instead the PFM/BFM solution can automatically suggest to invest any excess cash and the duration of these investments can match exactly with the investment horizon of the customer. This contrarily to today’s situation where customers with an investment horizon of X years are advised to keep part of their portfolio in assets which can be immediately liquidated (e.g. saving account) and part in investments with a shorter horizon (to have flexibility in case of shorter-term liabilities).

The LABL product takes away this burden for the customer, as it truly forms the bridge between the daily banking, investments and credits silos. Any excess money at the end of the month can be immediately invested in products matching the customer’s investment horizon (ideally via robo-advice), while any short-term liquidity needs can be automatically covered by LABL products. This way customers can finally outsource their financial management to the bank, allowing the customer to focus on what really matters.

PSD2 and Open Banking so far has mainly focussed on access to accounts and payment initiation. This has resulted in aggregation of data and payment services, which has formed the foundation for PFM/BFM solutions onto which further value added services can be offered. Examples are capabilities around budgeting, forecasting, saving goals, easy payment initiation via merchants, etc. LABL is perfectly compatible with the innovation roadmap for these PFM/BFM solutions.

Open banking for credits and investment is still in a very early stage, with some banks focussing on open APIs around the origination of new loans. By offering value-added services like LABL more actively in their daily banking app or PFM/BFM, banks automatically anticipate for the next waves of Open Banking.