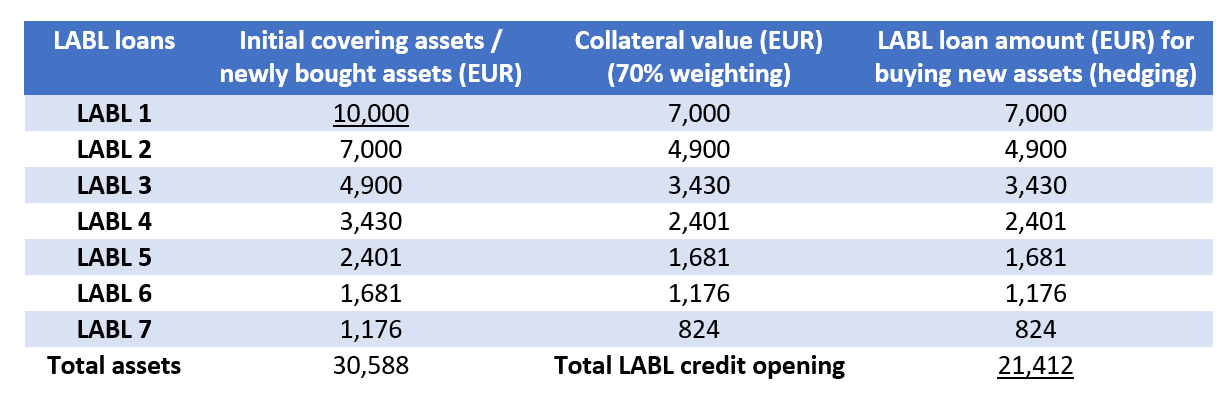

It shows that with an average collateral weighting of 70%, a client with 10,000 EUR of initial stock can borrow up to 21,412 EUR, i.e. the client obtains a potential leveraging effect of ~2.

In above simulation the customer ends up with :

- Invested assets for a total value of 30,588 EUR

- A cash amount of 824 EUR

Note that the overall risk for the bank remains the same, i.e. the total credit value is only 70% of the total asset value and the assets can still be liquidated.

There are multiple ways to avoid such undesired leveraging.

First, the bank can set maximum amounts on the full LABL credit portfolio, for example limited to 50,000 EUR for Retail customers, limited to 150.000 EUR for Mass Affluent customers, and limited to 1.000.000 EUR for Private Banking customers.

Second, the bank can check on maximum market value of collaterals compared to total asset value deposited at the bank, i.e. the total market value of the blocked positions (blocked as LABL credit collateral) should be less than 50% of the total asset value deposited at the bank.

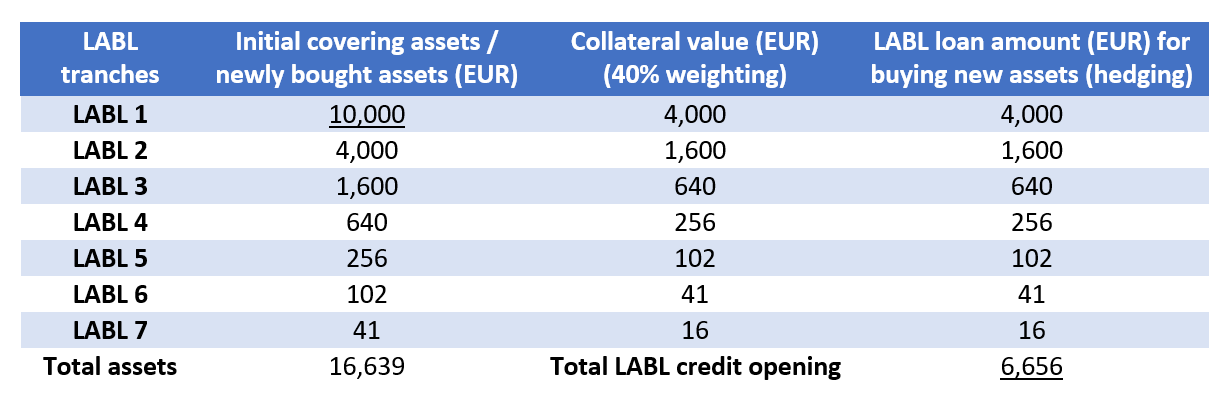

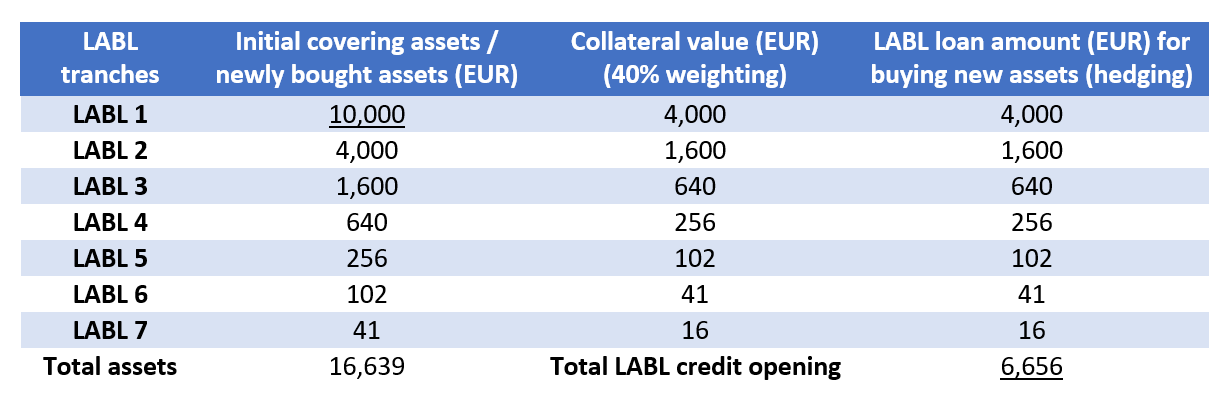

Another way to reduce the problem or undesired side-effect, can be obtained through using more conservative weightings. The following simulation with 40% collateral weighting illustrates that for a client with 10,000 EUR of initial stock, the potential hedged LABL credit opening is reduced to 6,656 EUR.

Be careful, this does not mean that the collateral weighting (or loan-to-asset ratio) was increased to 66% : Let’s not forget that each additional LABL loan is on its own covered by assets, hence the global risk and coverage level remain the same (6656 / 16636 = 40%).

Hedging simulation with 40% collateral weighting. Hedging effect has been strongly reduced.

Different algorithms exist for such weighting, depending on asset characteristics (asset type, sector, volatility, currency, etc.). It is also important to take diversification of the asset portfolio into account. The above leveraging is mainly increasing risk, if the loan amount is invested in same shares or in the same sector. This lack of diversification needs to be taken into account, when calculating the haircut, i.e. the less diversified the total portfolio and the total collateral portfolio, the higher the haircut percentage.

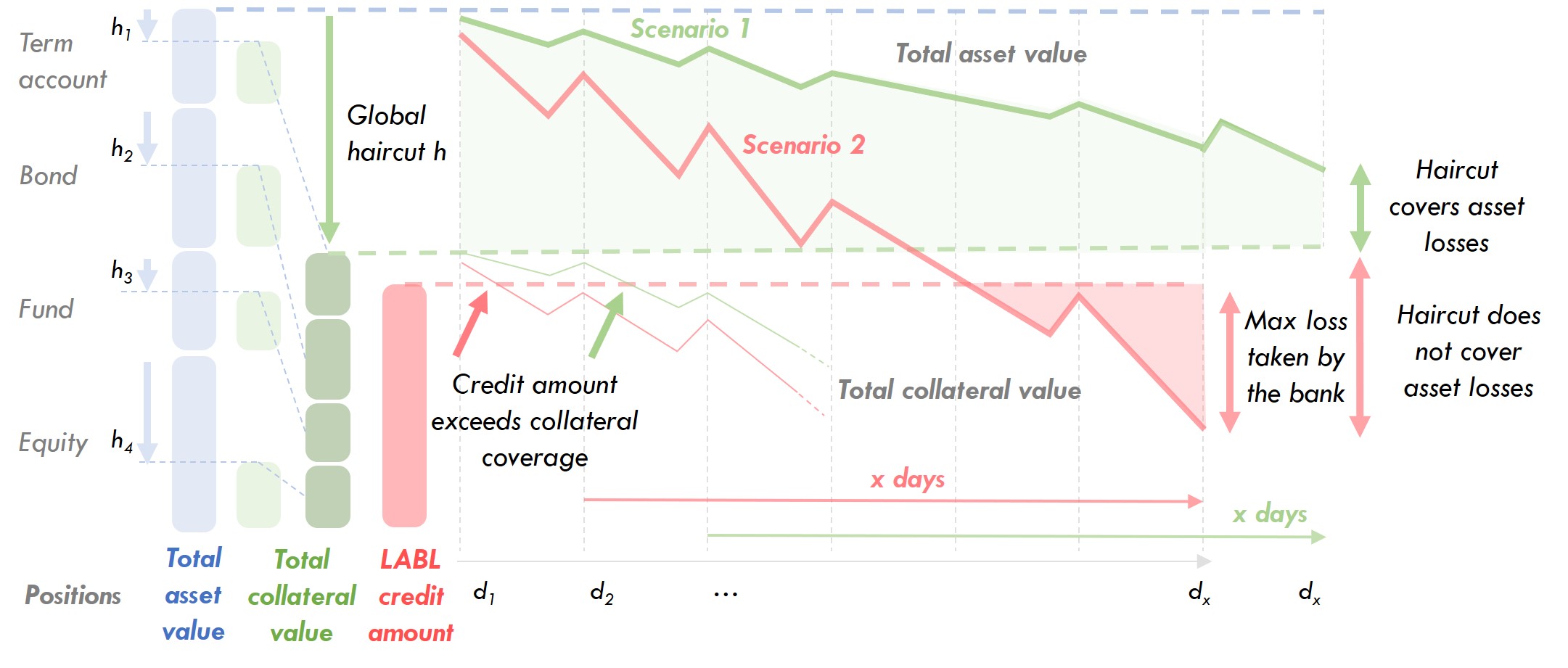

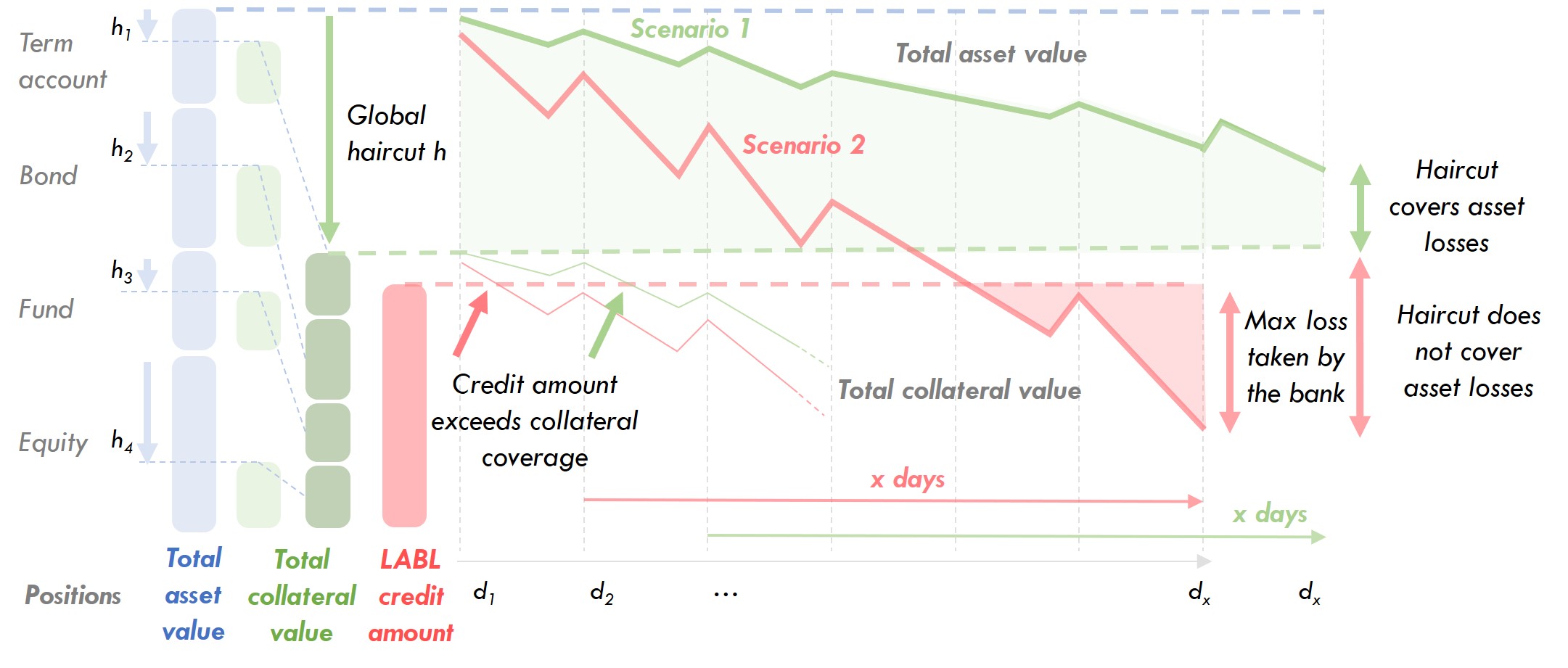

For both scenarios above, from the moment that the initial asset value goes below 10,000 EUR (e.g. 9,999 EUR) an alert is raised and the client is notified to take action within x days (below we will discuss the importance of these x days). Important: The same applies to all other assets that the client would have purchased with the released credit amount. Suppose that liquid assets actually drop -60% in x days (stock market crash), then the customer still has 4,000 EUR in initial shares, and 1,600 EUR in second tranche of shares he has bought, etc. and can still pay off the entire debt.

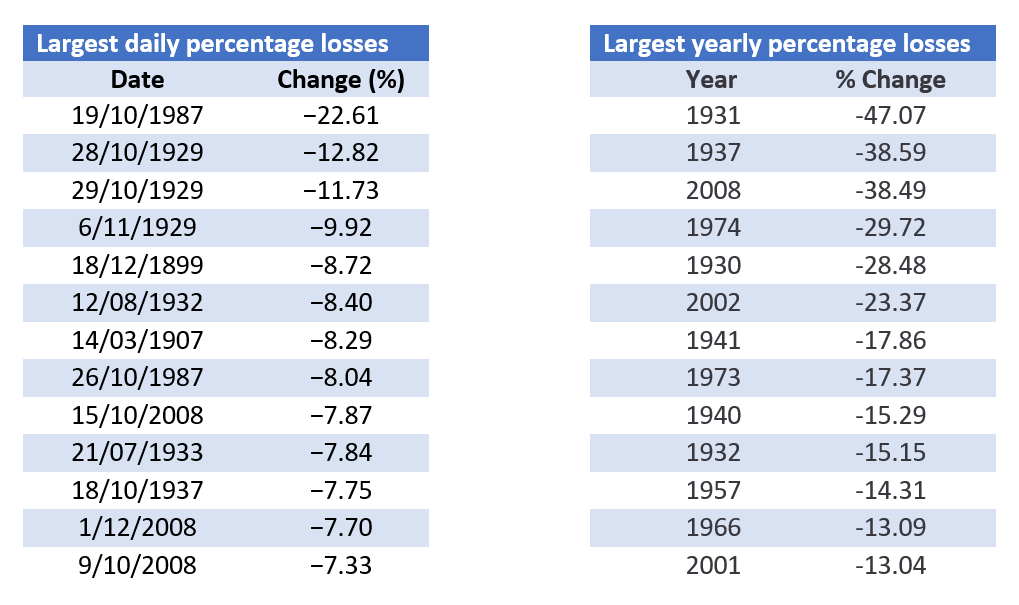

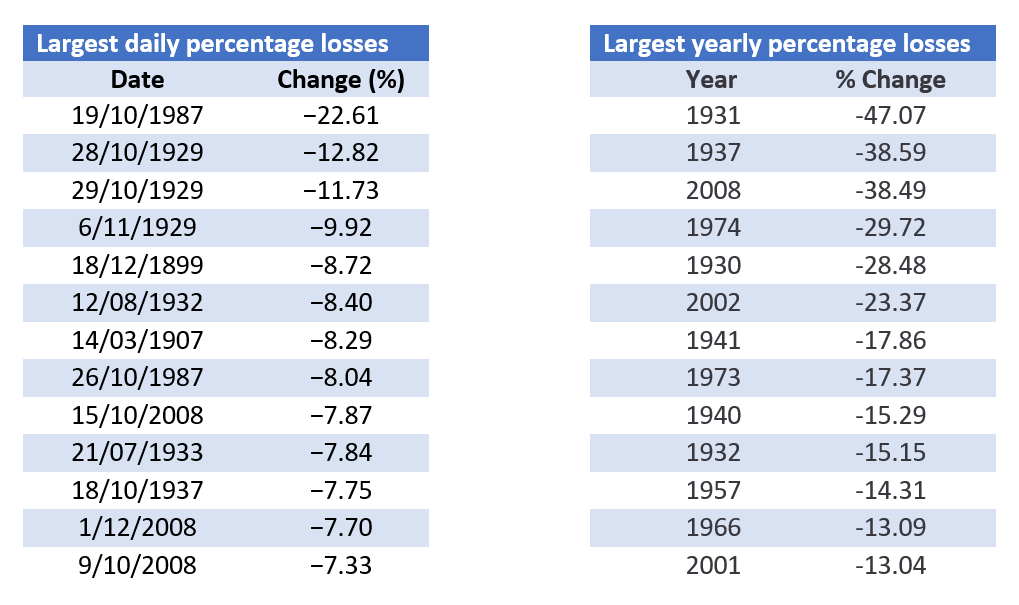

To answer the second question – “what in case of a systemic market crash?” – history shows that the stock market has never decreased by > 25% in one day with a maximum yearly percentage loss of 47% in 1931; a yearly loss of 38% was registered in the 2008 financial crisis. The S&P 500 lost approximately 50% of its value during the 2007-2009 period.

Largest daily and yearly percentage losses in the Dow Jones Industrial Average.

Source: Sizzlers and Fizzlers. us.spindices.com.

The nature of the LABL product is indeed such that if the stock market systemically crashes within the x days (the period within which either the customer can take action or the bank automatically takes / may take action in accordance with the framework agreement) below the haircut (-60%) then there is a big risk for customers to default. In case of non-recourse asset based lending contracts, banks will have to write off the difference between the remaining loan amount (e.g. 40%) and the collateral value (30%); -10%. It is thus extremely important to conservatively define the haircuts and ideally keep the period of x days as short as possible to protect both banks and customers, as illustrated below.

It is extremely important to conservatively define the haircuts and ideally keep the period of x days as short as possible to protect both banks and customers