Retail Securities Trading Tool (RSTT)

Enhance financial literacy through accessible investment tools

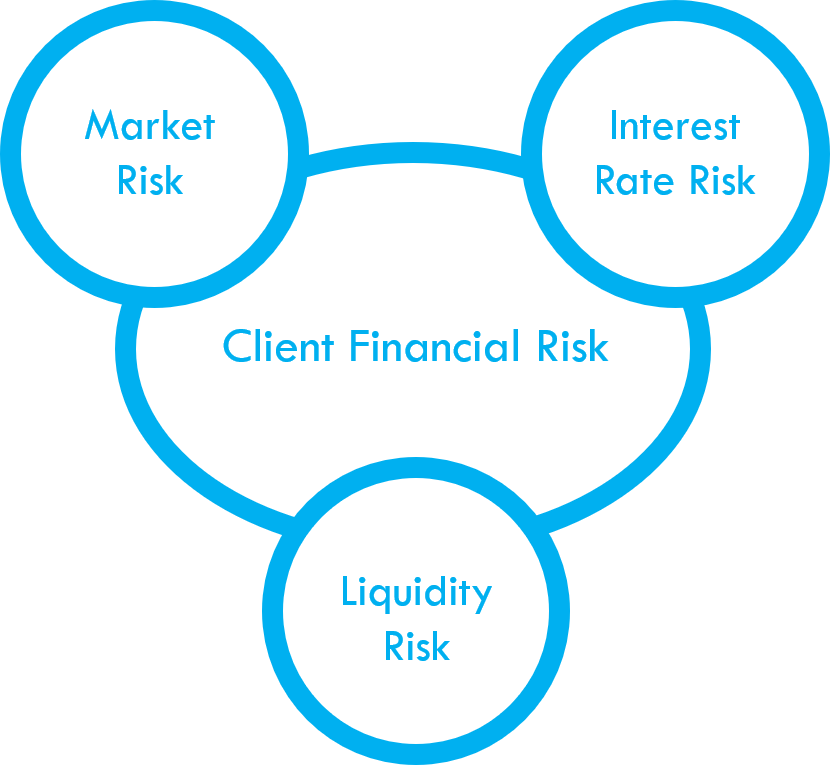

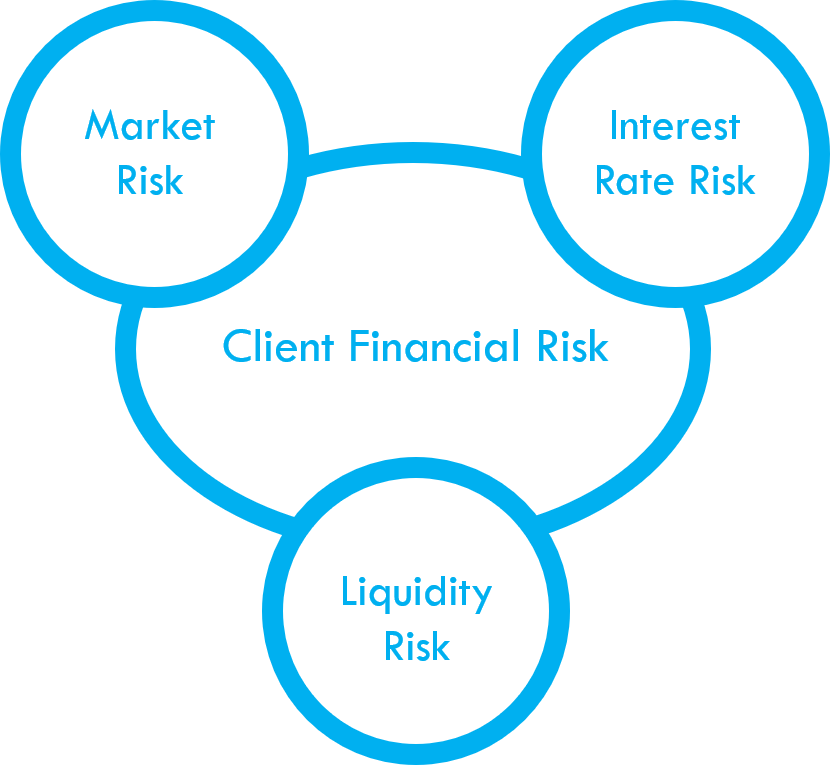

At Capilever we believe that it’s the job of the bank to explain complex financial products and services in the simplest possible way and assist customers manage their financial risk in the best and cheapest possible way. Our investment tool offers a step in the right direction.

Retail Securities Trading Tool (RSTT)

Enhance financial literacy through accessible investment tools

At Capilever we believe that it’s the job of the bank to explain complex financial products and services in the simplest possible way and assist customers manage their financial risk in the best and cheapest possible way. Our investment tool offers a step in the right direction.

Allow retail customers to invest their assets in individual securities with

✓ Minimized market risk

✓ Maximized capital guarantee

✓ Limited commission costs

✓ Maximal liquidity

Allow retail customers to invest their assets in individual securities with

✓ Minimized market risk

✓ Maximized capital guarantee

✓ Limited commission costs

✓ Maximal liquidity

Apply advanced risk hedging techniques

✓ Understand the taken market risk

✓ Differentiate the portfolio

✓ Eliminate the timing risk

✓ Limit maximum loss

✓ Capitalize profits

✓ Hedge losses

Apply advanced risk hedging techniques

✓ Understand the taken market risk

✓ Differentiate the portfolio

✓ Eliminate the timing risk

✓ Limit maximum loss

✓ Capitalize profits

✓ Hedge losses

WHAT ARE CUSTOMER BENEFITS OF RSTT?

Profit from advanced risk management techniques, without needing to have deep financial knowledge

Benefit from a highly liquid portfolio with capital protection at minimum costs

Automatic follow-up of your portfolio without having to actively follow-up your investment portfolio

Customer is still fully in control contrarily to most robo-advisors – High support self-service model

CUSTOMER BENEFITS

- Profit from advanced risk management techniques, without needing to have deep financial knowledge

- Benefit from a highly liquid portfolio with capital protection at minimum costs

- Automatic follow-up of your portfolio without having to actively follow-up your investment portfolio

- Customer is still fully in control contrarily to most robo-advisors – High support self-service model

WHAT ARE BANK BENEFITS OF RSTT?

BANK BENEFITS

- Higher transaction volumes, more individual positions and more active management of the portfolios

- Customer retention and acquisition via more extensive investment services

- Giving edge to customers resulting in increased customer satisfaction

- More liquid positions allowing easier usage for pledging via LABL tool

Thanks to RSTT, customers with little knowledge of securities can still optimize their portfolio from a risk point-of-view in a simple and user-friendly way

Thanks to RSTT, customers with little knowledge of securities can still optimize their portfolio from a risk point-of-view in a simple and user-friendly way

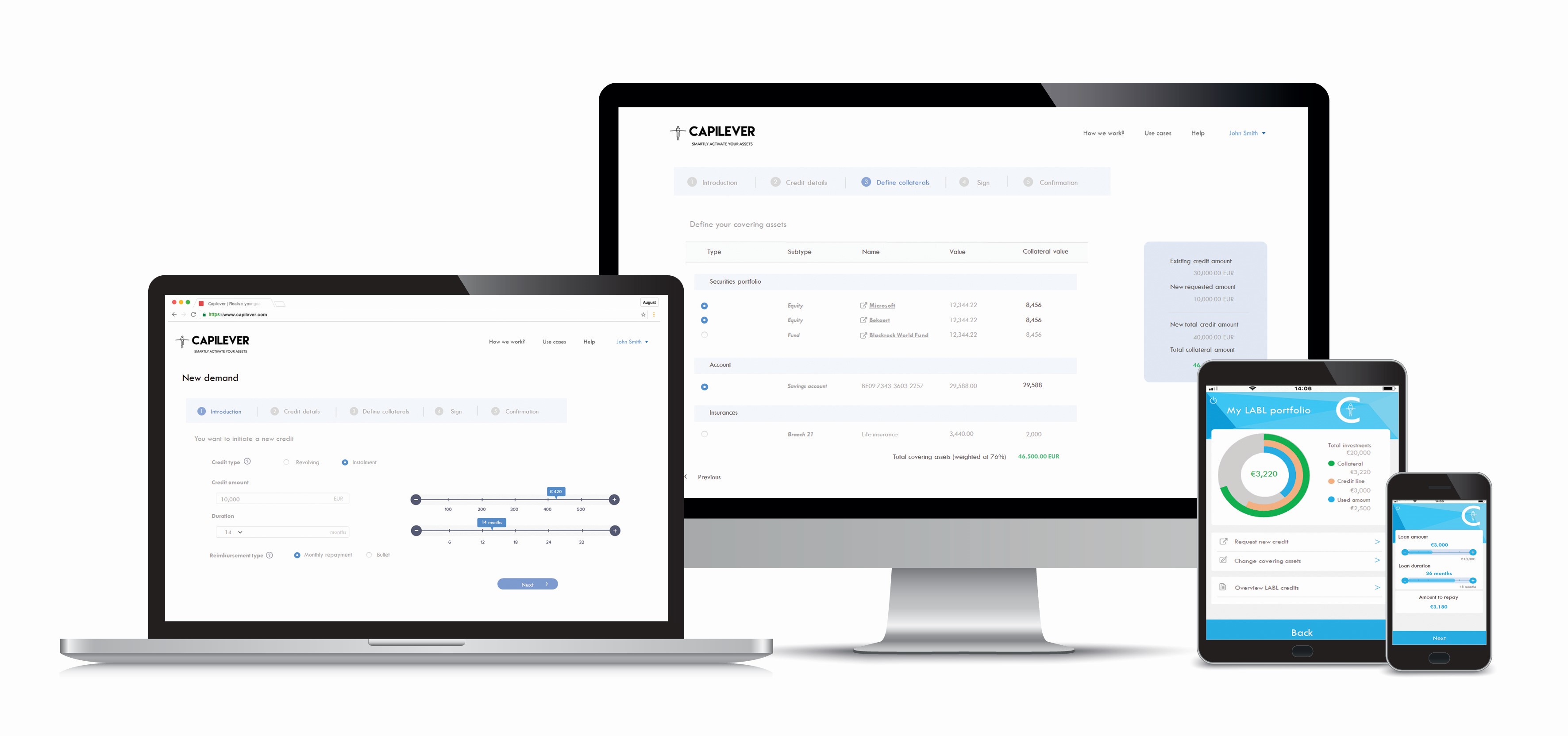

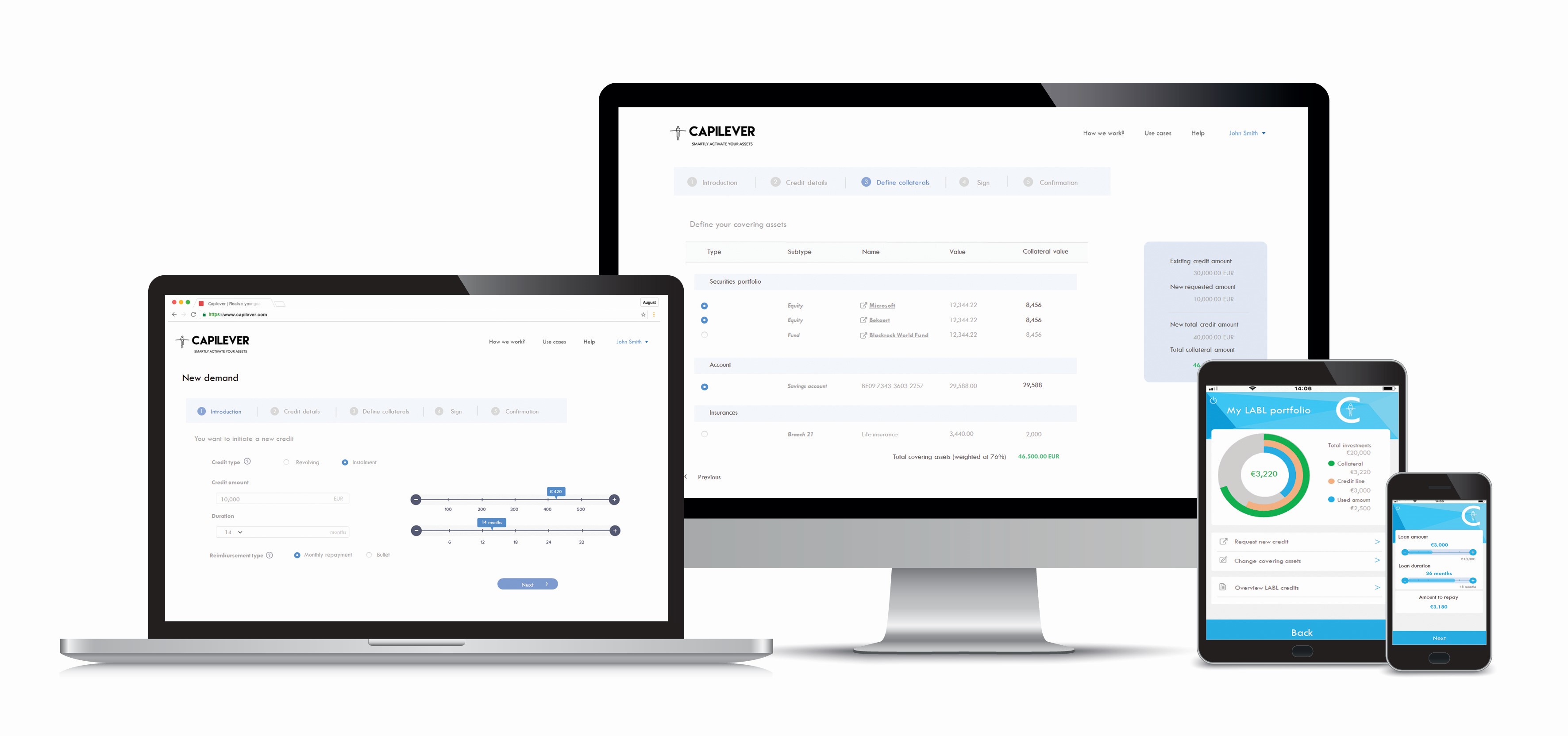

INTEGRATE OUR APIs INTO YOUR DAILY BANKING APP

RSTT USE CASES

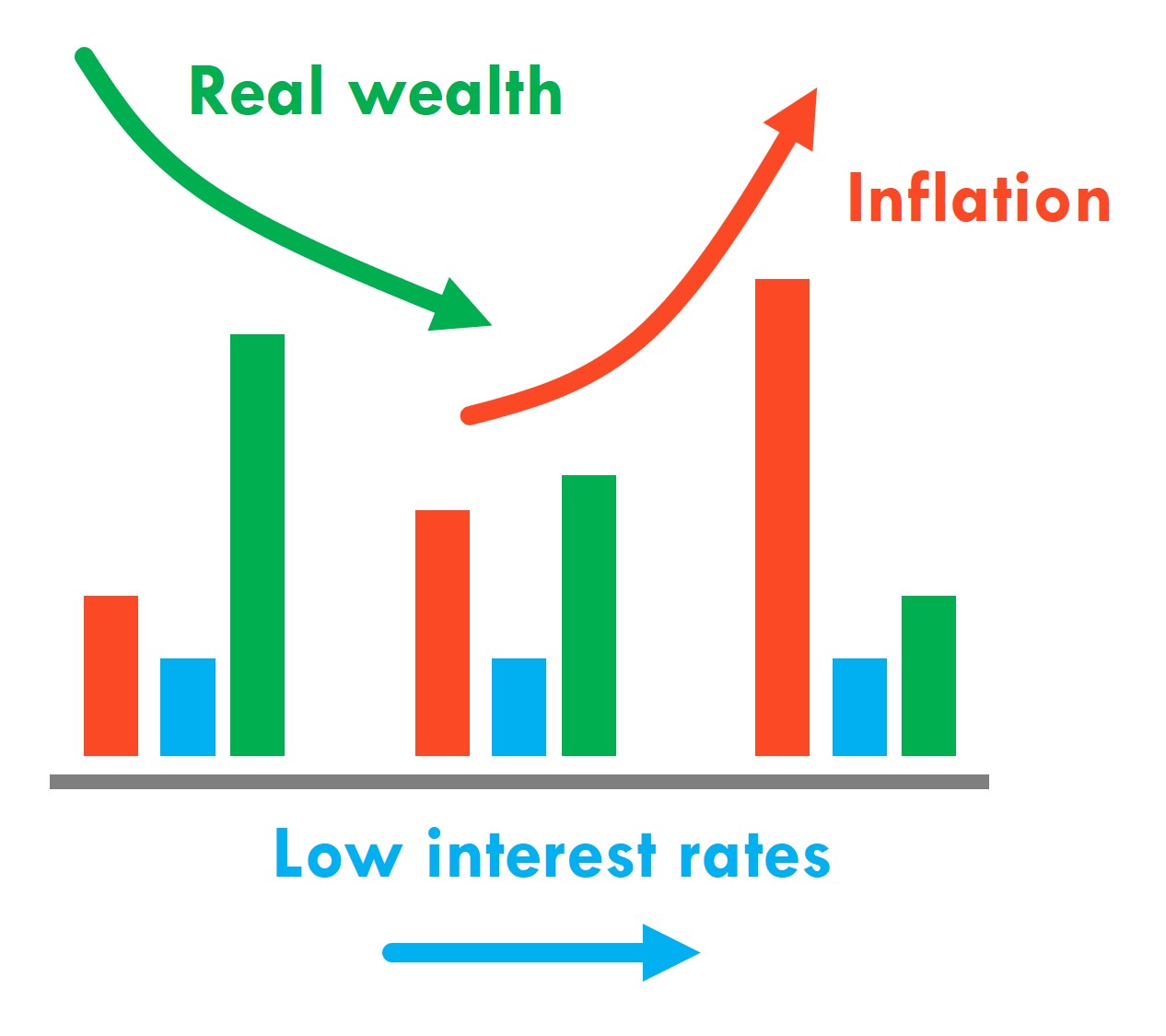

John has inherited some money. He has no experience with investments. Worried by high inflation rates, he checks options at his bank which offers accessible investment tools.

John has inherited some money. He has no experience with investments. Worried by high inflation rates, he checks options at his bank which offers accessible investment tools.

John has recently inherited €50.000 in cash. John has some interest in the financial news, but he is definitely not acquainted with trading stock. Furthermore John has a busy life, so he doesn’t want to spend much time on following up on his portfolio. Furthermore John has no direct need for the money, but the money – coming from an inheritance – has emotional value attached to it, so John wouldn’t like to lose too much of this money. At the same time, John is aware of the fact that most low-risk interest-rate linked products (saving accounts, term account and investment grade bonds) actually provide an interest rate lower than the inflation rate, so he wouldn’t want to see that this money is worth actually less when he wants to use it in 10 years.

John, having a busy life, prefers to do as much as possible self-service and online. Luckily his bank has just implemented the RSTT tool of Capilever, which actively assists John in his trading activities, without giving actual advise.

Understanding the risk you are taking

Sylvie is investing her money in equity, funds and bonds. Sylvie is aware that equity is a higher risk product than a bond, but has no idea how to compare different securities of the same security type. The RSTT tool shows this risk information in a graphical, intuitive and easy way. Complex financial measures like maximum drawdown, VaR and duration are shown in such a way that the risk impact of having a position in the security is explained. This way Sylvie can easily compare different securities from a risk perspective and take a deliberate and well-informed decision on which risk she is willing to take. If Sylvie considers a security as too risky, she can immediately look up another similar security (same security type, currency, region and/or sector) that provides a lower risk.

Differentiating your portfolio

Nancy has an existing investment portfolio with a number of positions. Nancy just received a well-deserved bonus from her company and wants to invest this money. Nancy has done some research and identified 3 companies in which she beliefs there is a good investment opportunity. The bonus is however not that big to invest in all 3 securities. Nancy therefore decides to reduce the risk of her investment portfolio, by maximizing the differentiation (i.e. minimizing the price correlation between the positions) in her portfolio. The RSTT tool allows to easily compare the impact on the portfolio variance between a buy order for the 3 securities. Based on this info, Nancy takes a decision.

Eliminating the timing risk

Jack has heard that investing in Apple is an excellent investment opportunity. However when Jack looks at the price graph of the Apple share, he is not really sure whether it’s the right moment (on the price curve) to buy Apple shares. Since it’s a long-term investment, Jack doesn’t need to buy on the minimum of the curve, but he does want to avoid buying at a local maximum on the curve. He decides therefore to spread his acquisition over time. The RSTT tool offers him an automated process, allowing to spread his acquisition over time, without Jack having to manually input an order every X weeks.

Limiting your maximum loss

Thomas wants to buy Tesla shares, but is worried about losing too much money in case his investment doesn’t turn out as expected. The RSTT tool allows Thomas to input directly a maximum loss compared to his position (average) acquisition price. When this maximum loss is exceeded, the position is immediately sold, thus limiting his loss to this maximum.

Capitalizing your profits

Peter wants to buy Apple shares and has read in an article that the share is currently 15% undervaluated. He beliefs that a lot of investors will follow this advice, meaning they will buy now, but likely also sell when this target price is reached. Peter therefore wants to capitalize his profit when 15% gain is reached, but also doesn’t want to follow-up the price continuously. The RSTT tool allows Peter to input directly a profit percentage, at which Peter wants to automatically capitalize his profits.

Hedging losses

Catherine wants to invest in Amazon, but she’s on her guard against too significant losses. Catherine therefore uses the option provided by the RSTT tool to hedge for losses. The tool explains in layman’s terms what the impact is of this hedging, for example that profits are capped or reduced, while at the same time losses are also reduced. Via some graphical simulations, Catherine sees for a few example scenarios how her P&L will look like when Amazon’s price increases/decreases.

John has inherited some money. He has no experience with investments. Worried by high inflation rates, he checks options at his bank which offers accessible investment tools.

John has recently inherited €50.000 in cash. John has some interest in the financial news, but he is definitely not acquainted with trading stock. Furthermore John has a busy life, so he doesn’t want to spend much time on following up on his portfolio. Furthermore John has no direct need for the money, but the money – coming from an inheritance – has emotional value attached to it, so John wouldn’t like to lose too much of this money. At the same time, John is aware of the fact that most low-risk interest-rate linked products (saving accounts, term account and investment grade bonds) actually provide an interest rate lower than the inflation rate, so he wouldn’t want to see that this money is worth actually less when he wants to use it in 10 years.

John, having a busy life, prefers to do as much as possible self-service and online. Luckily his bank has just implemented the RSTT tool of Capilever, which actively assists John in his trading activities, without giving actual advise.

Understanding the risk you are taking

Sylvie is investing her money in equity, funds and bonds. Sylvie is aware that equity is a higher risk product than a bond, but has no idea how to compare different securities of the same security type. The RSTT tool shows this risk information in a graphical, intuitive and easy way. Complex financial measures like maximum drawdown, VaR and duration are shown in such a way that the risk impact of having a position in the security is explained. This way Sylvie can easily compare different securities from a risk perspective and take a deliberate and well-informed decision on which risk she is willing to take. If Sylvie considers a security as too risky, she can immediately look up another similar security (same security type, currency, region and/or sector) that provides a lower risk.

Differentiating your portfolio

Nancy has an existing investment portfolio with a number of positions. Nancy just received a well-deserved bonus from her company and wants to invest this money. Nancy has done some research and identified 3 companies in which she beliefs there is a good investment opportunity. The bonus is however not that big to invest in all 3 securities. Nancy therefore decides to reduce the risk of her investment portfolio, by maximizing the differentiation (i.e. minimizing the price correlation between the positions) in her portfolio. The RSTT tool allows to easily compare the impact on the portfolio variance between a buy order for the 3 securities. Based on this info, Nancy takes a decision.

Eliminating the timing risk

Jack has heard that investing in Apple is an excellent investment opportunity. However when Jack looks at the price graph of the Apple share, he is not really sure whether it’s the right moment (on the price curve) to buy Apple shares. Since it’s a long-term investment, Jack doesn’t need to buy on the minimum of the curve, but he does want to avoid buying at a local maximum on the curve. He decides therefore to spread his acquisition over time. The RSTT tool offers him an automated process, allowing to spread his acquisition over time, without Jack having to manually input an order every X weeks.

Limiting your maximum loss

Thomas wants to buy Tesla shares, but is worried about losing too much money in case his investment doesn’t turn out as expected. The RSTT tool allows Thomas to input directly a maximum loss compared to his position (average) acquisition price. When this maximum loss is exceeded, the position is immediately sold, thus limiting his loss to this maximum.

Capitalizing your profits

Peter wants to buy Apple shares and has read in an article that the share is currently 15% undervaluated. He beliefs that a lot of investors will follow this advice, meaning they will buy now, but likely also sell when this target price is reached. Peter therefore wants to capitalize his profit when 15% gain is reached, but also doesn’t want to follow-up the price continuously. The RSTT tool allows Peter to input directly a profit percentage, at which Peter wants to automatically capitalize his profits.

Hedging losses

Catherine wants to invest in Amazon, but she’s on her guard against too significant losses. Catherine therefore uses the option provided by the RSTT tool to hedge for losses. The tool explains in layman’s terms what the impact is of this hedging, for example that profits are capped or reduced, while at the same time losses are also reduced. Via some graphical simulations, Catherine sees for a few example scenarios how her P&L will look like when Amazon’s price increases/decreases.

Ready to get Started ?

Happy to discuss your next Credit & Investment innovation project